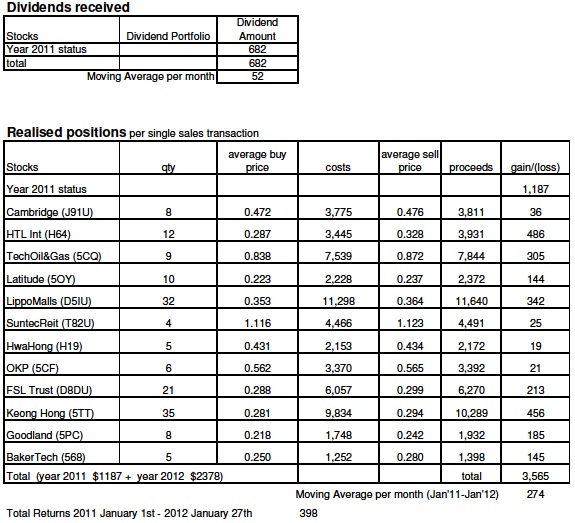

Here are some details on the stocks purchased and sold under Cash portfolio this week :-

TechOil&Gas (5CQ)

Expected dividend payment in February and interim dividend amount estimates of $270 for 9 lots.

To get advance payment on the dividend, sold 9 lots (in January) at nett gain amount of $305.

Future plan to re-invest when stock price is weaker so, a possible cycle of the above.

Latitude (5OY)

Expected dividend payment in March and interim dividend amount estimates of $140 for 10 lots.

To get advance payment on the dividend, sold 10 lots (in January) at nett gain amount of $144.

No immediate future plan to re-invest in this stock.

LippoMalls (D5IU)

Expected dividend payment in March and interim dividend amount estimates of $355 for 32 lots.

To get advance payment on the dividend, sold 32 lots (in January) at nett gain amount of $342.

Future plan to re-invest when stock price is weaker so, a possible cycle of the above.

SuntecReit (T82U)

Expected dividend payment in March and interim dividend amount estimates of $13 to $24 for 4 lots.

To get advance payment on the dividend, sold 4 lots (in January) at nett gain amount of $25.

No immediate future plan to re-invest in this stock.

HTL

Int (H64)

Expected dividend payment in May and interim dividend amount estimates of $480 for 12 lots.

To get advance payment on the dividend, sold 12 lots (in January) at nett gain amount of $486.

Future plan to re-invest when stock price is weaker so, a possible cycle of the above.

K-REIT (K71U)

Bought 5 lots in time for interim dividend going ex-date end January. Will sell stock earlier than scheduled if price hits estimated interim dividend amount otherwise hold till next review during subsequent dividend ex-date in July month.

OKP (5CF)

Was planning to sell entire 3 lots holding. But wrongly entered sell queue as buy queue at higher price. So, l have doubled my holding on this stock at 6 lots due to mistake. Will sell stock earlier if price hits estimated interim dividend amount

before ex-date in May month otherwise hold till next review during subsequent dividend

ex-date in August month.

Keong Hong (5TT)

Bought 35 lots for its dividend ex-date in February. Will sell

stock earlier if price hits estimated dividend amount otherwise hold for selling into strength at break-even. This is a risky counter during this weak property outlook for Singapore. But am hoping that it is still able to shine as its business activities covers a broad range of building construction services not just for residential but also for commercial, industrial and institutional projects. I will be extremely cautious to go long on this company as its income statement seems so bad with very thin profit margin.