Received a cheque early this week from Mun Siong for dividends of $60. Mun Siong pays dividends only once in a year and the dividend amount was lowered from $0.01 (ROC 7.2%) to $0.006 (ROC 4.3%) and so, this is a disappointment. My investment value in Mun Siong though has dropped by 24% but the paper loss is still small at $363 because the amount invested is less than $2k. It has a healthy balance sheet and a healthy order book. But l am concern of its gross profit margin which of late has been under pressure. Because of lower dividend and a pressured gross profit margin, l will try to sell Mun Siong away at breakeven but l will have to average down first.

Added another 7 lots on TPV this week. TPV released a disappointing 1Q2012 results this week. Its revenue came in 13% lesser than a year ago. Gross profit margin is almost flat at 6%. In just 3 months, its cash and cash equivalents dropped 41%; current ratio is now at 0.92 times from 0.96 times. Combined sales to China and Europe is about 55% of total sales; China growth is slowing down and costs of doing business there has gone up; Europe is in serious mess so looks like extremely tough time ahead for TPV. Reason for additional 7 lots this week is to average down and am hoping to eventually looking at reducing my investment in TPV. Time being, will have to continue averaging down if its share price weakens further.

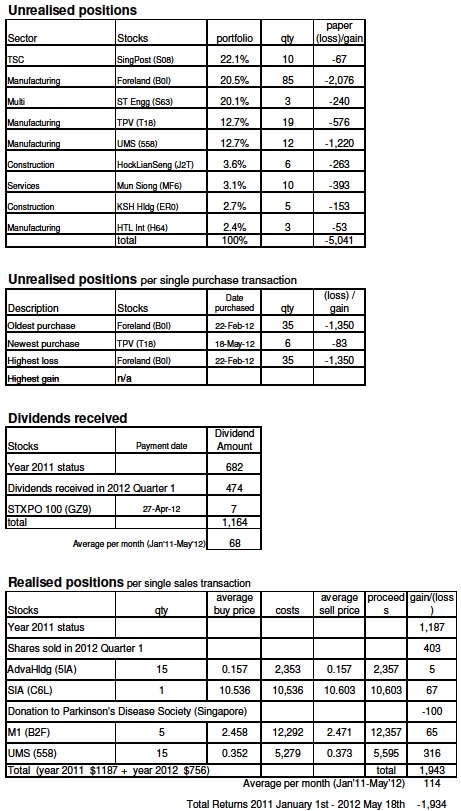

Portfolio walk since previous posting :-

-$1,963 Total Returns as of 18 May

+$60 Dividends from Mun Siong

+$689 Unrealised positions improved

-$1,215 Total Returns as of 25 May

previous posting :- Cash - Closing Status 18 May

Added another 7 lots on TPV this week. TPV released a disappointing 1Q2012 results this week. Its revenue came in 13% lesser than a year ago. Gross profit margin is almost flat at 6%. In just 3 months, its cash and cash equivalents dropped 41%; current ratio is now at 0.92 times from 0.96 times. Combined sales to China and Europe is about 55% of total sales; China growth is slowing down and costs of doing business there has gone up; Europe is in serious mess so looks like extremely tough time ahead for TPV. Reason for additional 7 lots this week is to average down and am hoping to eventually looking at reducing my investment in TPV. Time being, will have to continue averaging down if its share price weakens further.

Portfolio walk since previous posting :-

-$1,963 Total Returns as of 18 May

+$60 Dividends from Mun Siong

+$689 Unrealised positions improved

-$1,215 Total Returns as of 25 May

previous posting :- Cash - Closing Status 18 May