Summary of investing status as of 1Q2013.

If not for the oversold mistake on a stock (loss $95) and selling away an old bad investment (loss $4474) then my CPF portfolio would have generated a realized amount of $1324. So, even though there is a negative realized amount when adding up the three

portfolios together, l am quite happy with my 1st quarter performance.

Donation

Blog Archive

Sunday 31 March 2013

SRS - Closing Status 28 Mar

Just to consolidate Jan'13 to Mar'13 realized transaction for SRS portfolio for Quarter 1.

Portfolio walk since previous posting :-

+$5,781 Total Returns as of 22 Mar

-$60 Unrealised positions worsened

+$5,721 Total Returns as of 28 Mar

previous posting :- SRS - Closing status 22 Mar

Portfolio walk since previous posting :-

+$5,781 Total Returns as of 22 Mar

-$60 Unrealised positions worsened

+$5,721 Total Returns as of 28 Mar

previous posting :- SRS - Closing status 22 Mar

CPF - Closing Status 28 Mar

Just to consolidate Jan'13 to Mar'13 realized transaction for CPF portfolio for Quarter 1.

Portfolio walk since previous posting :-

+$393 Unrealised positions improved

previous journals :- CPF - Closing Status 15 Mar

Portfolio walk since previous posting :-

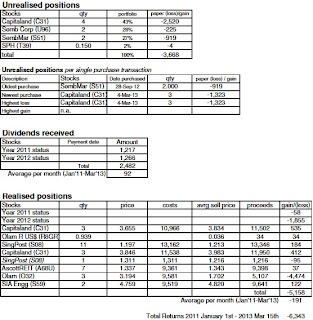

-$6,343 Total Returns as of 15 Mar

+$393 Unrealised positions improved

-$5,951 Total

Returns as of 28 Mar

previous journals :- CPF - Closing Status 15 Mar

Cash - Closing Status 29 Mar

For my Cash portfolio I sold away Perennial China Retail Trust 1 lot this week at break even as l am hoping to re-enter for it at lower price level. l hope l have taken the right action? Let's see.

Portfolio walk since previous posting :-

+$1,340 Total Returns as of 22 Mar

+$2 Gain on sales of Perennial China Retail Trust

-$252 Unrealised positions worsened

+$1,090 Total Returns as of 28 Mar

previous posting :- Cash - Closing Status 22 Mar

Portfolio walk since previous posting :-

+$1,340 Total Returns as of 22 Mar

+$2 Gain on sales of Perennial China Retail Trust

-$252 Unrealised positions worsened

+$1,090 Total Returns as of 28 Mar

previous posting :- Cash - Closing Status 22 Mar

Sunday 24 March 2013

SRS - Closing Status 22 Mar

I have sold away my SembCorp Industries 2 lots this week from my SRS portfolio. Did not manage to sell it away at a much higher price level as l have settled for a smaller $48 profit instead. It will go XD on 29 April. My confidence level was slightly shaken by world markets roller coaster swings due to the Cyprus crisis. As l was already in profit position on SembCorp Industries so l have decided to take profit first. l am hoping for a good price level level to re-invest into SembCorp Industries; before its XD date.

Portfolio walk since previous posting :-

+$5,900 Total Returns as of 15 Mar

+$48 Gain on sales of SembCorp Industries

-$167 Unrealised positions worsened

+$5,781 Total Returns as of 22 Mar

previous posting :- SRS - Closing status 15 Mar

Portfolio walk since previous posting :-

+$5,900 Total Returns as of 15 Mar

+$48 Gain on sales of SembCorp Industries

-$167 Unrealised positions worsened

+$5,781 Total Returns as of 22 Mar

previous posting :- SRS - Closing status 15 Mar

Saturday 23 March 2013

Cash - Closing Status 22 Mar

For my Cash portfolio this week, l have invested into Cache Logistics 1 lot when there was a quick sell off on its share when the company announced private placement of its shares to fund acquisition of a Gul Way property. Anyway l did not manage getting the lowest share price on Tuesday. Cache also declared advance dividends of $0.0212 which went XD in the same week, on Friday. For my holding of 1 lot l will be getting $21 of dividends amount payable to me on 26 April. l have managed to sell away my 1 lot holding before its XD date for a profit of $23 so l have already collected my dividends entitlement in advance (before 26 April).

Portfolio walk since previous posting :-

+$1,065 Total Returns as of 15 Mar

+$23 Gain on sales of Cache Logistics

+$251 Unrealised positions improved

+$1,340 Total Returns as of 22 Mar

previous posting :- Cash - Closing Status 15 Mar

Portfolio walk since previous posting :-

+$1,065 Total Returns as of 15 Mar

+$23 Gain on sales of Cache Logistics

+$251 Unrealised positions improved

+$1,340 Total Returns as of 22 Mar

previous posting :- Cash - Closing Status 15 Mar

Saturday 16 March 2013

SRS - Closing Status 15 Mar

GRP went XD this week and its intraday stock price was $0.30 - $0.315. Based on 21 lots holding in GRP under my SRS portfolio, l would have booked a loss between $902 - $588 if have sold it all away after it went XD. But l would have collected dividend amount of $1,050 per its dividend rate of $0.05. So if l have sold it away after XD then my nett profit (dividend collected less divestment loss) would be between $148 - $462. But alas, l did not have the courage to face the unknown on what its stock price will be after XD so l have sold it all away before it went XD for a profit of $148. At Friday's closing bell, there are :- Sell 334 lots at $0.315 vs Buy 25 lots at $0.305. At half time, GRP results were mixed whereby revenue was flat and profit was higher; positive operating cash flow but lower vs comparative period; healthy current ratio. Will re-invest into GRP if its share price weakens to around $0.23 - $0.26.

Invested into SembCorp Industries 2 lots this week under my SRS portfolio. Its share price continue to weakens since it reported two weeks ago of a 7% drop in profit. Its share price ought to stabilize soon, l hope. Marine segment will continue to weigh down on its overall profit but SembCorp is not the only company facing with margin squeeze challenge. SembCorp Industries has other business segments which will either cushion its overall profit fall or improving on its overall profit.

Portfolio walk since previous posting :-

+$5,577 Total Returns as of 8 Mar

+$148 Gain on sales of GLP

+$175 Unrealised positions improved

+$5,900 Total Returns as of 15 Mar

previous posting :- SRS - Closing status 8 Mar

Invested into SembCorp Industries 2 lots this week under my SRS portfolio. Its share price continue to weakens since it reported two weeks ago of a 7% drop in profit. Its share price ought to stabilize soon, l hope. Marine segment will continue to weigh down on its overall profit but SembCorp is not the only company facing with margin squeeze challenge. SembCorp Industries has other business segments which will either cushion its overall profit fall or improving on its overall profit.

Portfolio walk since previous posting :-

+$5,577 Total Returns as of 8 Mar

+$148 Gain on sales of GLP

+$175 Unrealised positions improved

+$5,900 Total Returns as of 15 Mar

previous posting :- SRS - Closing status 8 Mar

Cash - Closing Status 15 Mar

In this week l did a little thinking on my investments in growth stocks and have decided to sell them away, for now.

Invested into growth stock Tat Hong 1 lot last week but have decided to divest it away for a small profit of $7 in this week. I am certain its full year financial will achieve a double digit growth rate on revenue and profit. And going into FY2014 is it able to match or maintain the growth rates achieved in FY2013? If Tat Hong is not able to keep up its growth momentum in FY2014 then l do see it as a potential pressure on its share price from climbing higher. It last achieved 52 weeks high at $1.60 on 14 Feb and it is an important price resistance level to overcome. Its annual dividend yield is only around 2.0% at current price level so unless it decides to pay an even higher dividend rate it is very unlikely for me to re-invest into Tat Hong.

The last time l have invested into First Resources was in Jan'13 and l have decided to re-visit it this week for my Cash portfolio. But my investment in First Resources 1 lot did not survive through the week as l have divested it away for a small profit of $11. l continue to view First Resources positively in terms of growth potential but at the same time l am quite unhappy with its annual dividend yield which is 2.18% at current price level. Its current price level is quite far away from its 52 weeks high of $2.23 achieved back in Aug'12. l see great volatility in its share price movement which is great opportunity for traders but certainly not for normal investor like myself when invested into it and stuck with it at higher price level and hence only have to depend on it for low income stream of dividend yield at 2.18%. This explains for the reason in keeping my investment low in growth stock like First Resources. l will participate in First Resources growth potential on an ongoing basis (rotational) so long as its share price is still far away from its 52 weeks high but my future investment in it will be kept to 1 lot of investment, at most.

GRP went XD this week and its intraday stock price was $0.30 - $0.315. Based on 11 lots holding in GRP under my Cash portfolio, l would have booked a loss between $448 - $283 if have sold it all away after it went XD. But l would have collected dividend amount of $550 per its dividend rate of $0.05. So if l have sold it away after XD then my nett profit (dividend collected less divestment loss) would be between $102 - $267. But alas, l did not have the courage to face the unknown on what its stock price will be after XD so l have sold it all away before it went XD for a profit of $101. At Friday's closing bell, there are :- Sell 334 lots at $0.315 vs Buy 25 lots at $0.305. At half time, GRP results were mixed whereby revenue was flat and profit was higher; positive operating cash flow but lower vs comparative period; healthy current ratio. Will re-invest into GRP if its share price weakens to around $0.23 - $0.26.

I have re-invested into Duty Free 3 lots this week under Cash portfolio. Its 9M2013 results have been good though could have been better if not for the increases in certain expenses categories. Using 3Q2012 running rate Duty Free should be able to hold its financials growth rates in 9M2013 at full time.There is potential annual dividend yield of around 5.0% which is quite okay just in case l got stuck in it at current price level; which is quite near to its 52 weeks high of $0.48 achieved in Feb'13.

Portfolio walk since previous posting :-

+$984 Total Returns as of 8 Mar

+$119 Gain on sales of Tat Hong, First Resources and GRP

-$37 Unrealised positions worsened

+$1,065 Total Returns as of 15 Mar

previous posting :- Cash - Closing Status 8 Mar

Invested into growth stock Tat Hong 1 lot last week but have decided to divest it away for a small profit of $7 in this week. I am certain its full year financial will achieve a double digit growth rate on revenue and profit. And going into FY2014 is it able to match or maintain the growth rates achieved in FY2013? If Tat Hong is not able to keep up its growth momentum in FY2014 then l do see it as a potential pressure on its share price from climbing higher. It last achieved 52 weeks high at $1.60 on 14 Feb and it is an important price resistance level to overcome. Its annual dividend yield is only around 2.0% at current price level so unless it decides to pay an even higher dividend rate it is very unlikely for me to re-invest into Tat Hong.

The last time l have invested into First Resources was in Jan'13 and l have decided to re-visit it this week for my Cash portfolio. But my investment in First Resources 1 lot did not survive through the week as l have divested it away for a small profit of $11. l continue to view First Resources positively in terms of growth potential but at the same time l am quite unhappy with its annual dividend yield which is 2.18% at current price level. Its current price level is quite far away from its 52 weeks high of $2.23 achieved back in Aug'12. l see great volatility in its share price movement which is great opportunity for traders but certainly not for normal investor like myself when invested into it and stuck with it at higher price level and hence only have to depend on it for low income stream of dividend yield at 2.18%. This explains for the reason in keeping my investment low in growth stock like First Resources. l will participate in First Resources growth potential on an ongoing basis (rotational) so long as its share price is still far away from its 52 weeks high but my future investment in it will be kept to 1 lot of investment, at most.

GRP went XD this week and its intraday stock price was $0.30 - $0.315. Based on 11 lots holding in GRP under my Cash portfolio, l would have booked a loss between $448 - $283 if have sold it all away after it went XD. But l would have collected dividend amount of $550 per its dividend rate of $0.05. So if l have sold it away after XD then my nett profit (dividend collected less divestment loss) would be between $102 - $267. But alas, l did not have the courage to face the unknown on what its stock price will be after XD so l have sold it all away before it went XD for a profit of $101. At Friday's closing bell, there are :- Sell 334 lots at $0.315 vs Buy 25 lots at $0.305. At half time, GRP results were mixed whereby revenue was flat and profit was higher; positive operating cash flow but lower vs comparative period; healthy current ratio. Will re-invest into GRP if its share price weakens to around $0.23 - $0.26.

I have re-invested into Duty Free 3 lots this week under Cash portfolio. Its 9M2013 results have been good though could have been better if not for the increases in certain expenses categories. Using 3Q2012 running rate Duty Free should be able to hold its financials growth rates in 9M2013 at full time.There is potential annual dividend yield of around 5.0% which is quite okay just in case l got stuck in it at current price level; which is quite near to its 52 weeks high of $0.48 achieved in Feb'13.

Portfolio walk since previous posting :-

+$984 Total Returns as of 8 Mar

+$119 Gain on sales of Tat Hong, First Resources and GRP

-$37 Unrealised positions worsened

+$1,065 Total Returns as of 15 Mar

previous posting :- Cash - Closing Status 8 Mar

CPF - Closing Status 15 Mar

Finally sold away Olam 3 lots under my CPF portfolio this week at a huge loss of $4,474. This was an investment mistake made in my earlier investment years which was based on rumour mill (or better known as tips). The huge loss is very painful to bear but l prefer not to keep it bothering me now that l have got rid of it.

Olam is a growth stock and from it l must always remember to be very careful when considering investing into any other growth stocks. When a growth stock is in a paper loss status then there is almost no income stream from its dividends; so it becomes a very bad investment decision made particularly in a bear market or when its share price heavily underperformed in a bull market.

I have divested SIA Engineering 2 lots from my CPF portfolio this week for a profit of $122. For 9M2013, both revenue and profit were almost at par to previous year. Last year there was an exchange gain of $7.5 mil but in this year it recorded an exchange loss of $2.1 mil. There is no borrowings as of 9M2013. I think it is a good deal to invest into SIA Engineering expecially when its dividend yield is at 4.6%. Its next XD is in May'13 so l will re-invest into it when its share price weakens in the coming weeks or months.

Portfolio walk since previous posting :-

+$3,630 Unrealised positions improved

previous journals :- CPF - Closing Status 8 Mar

Olam is a growth stock and from it l must always remember to be very careful when considering investing into any other growth stocks. When a growth stock is in a paper loss status then there is almost no income stream from its dividends; so it becomes a very bad investment decision made particularly in a bear market or when its share price heavily underperformed in a bull market.

I have divested SIA Engineering 2 lots from my CPF portfolio this week for a profit of $122. For 9M2013, both revenue and profit were almost at par to previous year. Last year there was an exchange gain of $7.5 mil but in this year it recorded an exchange loss of $2.1 mil. There is no borrowings as of 9M2013. I think it is a good deal to invest into SIA Engineering expecially when its dividend yield is at 4.6%. Its next XD is in May'13 so l will re-invest into it when its share price weakens in the coming weeks or months.

Portfolio walk since previous posting :-

-$5,622 Total Returns as of 8 Mar

-$4,352 Total Net Loss from sales of Olam (loss -$4,474) and SIA Engg (profit $122)

-$4,352 Total Net Loss from sales of Olam (loss -$4,474) and SIA Engg (profit $122)

+$3,630 Unrealised positions improved

-$6,343 Total

Returns as of 15 Mar

previous journals :- CPF - Closing Status 8 Mar

Sunday 10 March 2013

SRS - Closing Status 8 Mar

Received SRS statement for Feb'13 month from the bank this week and it showed $40 dividends received from SGX.

I have divested my stock holding in GLP (Global Logistics Properties) 5 lots this week from my SRS portfolio for a gain of $110.

Portfolio walk since previous posting :-

+$5,311 Total Returns as of 1 Mar

+$40 Dividends collected from SGX

+$110 Gain on sales of GLP

+$115 Unrealised positions improved

+$5,577 Total Returns as of 8 Mar

previous posting :- SRS - Closing status 1 Mar

I have divested my stock holding in GLP (Global Logistics Properties) 5 lots this week from my SRS portfolio for a gain of $110.

Portfolio walk since previous posting :-

+$5,311 Total Returns as of 1 Mar

+$40 Dividends collected from SGX

+$110 Gain on sales of GLP

+$115 Unrealised positions improved

+$5,577 Total Returns as of 8 Mar

previous posting :- SRS - Closing status 1 Mar

CPF - Closing Status 8 Mar

Under CPF portfolio this week, l have added Capitaland 3 lots so my total holding in it now at 4 lots. And its share price started moving lower since then. The only reason l can think of that causing its share price to go lower is because of China property curbs to cool property prices. Property companies like Capitaland will be able to find ways around it somehow. It is really a knee jerk effect that the share price of property counters gone lower at the moment. Their share price recovery will happen really soon.

I have invested into SIA Engineering 2 lots this week under my CPF portfolio. For 9M2013, both revenue and profit were almost at par to previous year. Last year there was an exchange gain of $7.5 mil but in this year it recorded an exchange loss of $2.1 mil. I think it is a good deal to invest into SIA Engineering expecially when its dividend yield is at 4.6%. There is no borrowings as of 9M2013.

Portfolio walk since previous posting :-

-$890 Unrealised positions worsened

previous journals :- CPF - Closing Status 1 Mar

I have invested into SIA Engineering 2 lots this week under my CPF portfolio. For 9M2013, both revenue and profit were almost at par to previous year. Last year there was an exchange gain of $7.5 mil but in this year it recorded an exchange loss of $2.1 mil. I think it is a good deal to invest into SIA Engineering expecially when its dividend yield is at 4.6%. There is no borrowings as of 9M2013.

Portfolio walk since previous posting :-

-$4,731 Total Returns as of 1 Mar

-$890 Unrealised positions worsened

-$5,622 Total

Returns as of 8 Mar

previous journals :- CPF - Closing Status 1 Mar

Saturday 9 March 2013

Cash - Closing Status 8 Mar

Singapore Shipping Corpn (Sp Ship) is likely to announce a dividend rate of $0.01 (same as last year) in its full year results around 22 May'13 and based on past dividends, it will XD in early Aug 2013. For my holding in Sp Ship 10 lots, l can expect a dividend amount of $100 (10 lots x dividend rate $0.01). I have divested all of Sp Ship 10 lots under Cash portfolio in this week for a profit of $38; collecting a partial advance dividends. I am hoping to re-invest into Sp Ship at lower share price level.

Just realized that Duty Free pays a very small dividend rate of $0.0025 when it announced 4Q2012 results last year. Based on my 2 lots holding of Duty Free, the expected dividend amount will be $5 ($0.0025 x 2 lots). So this week l have decided to collect an advance dividend from Duty Free when l sold it away for a gain of $25 or a dividend yield of 2.9% based on my invested funds in it. l am hoping to re-invest into Duty Free when its share price is at a lower level as its current annual dividend yield is at 5.1%.

Invested into Tat Hong 1 lot this week under Cash portfolio. Its 9M2013 is quite good though its biggest revenue segment on Distribution came in softer at -7% in 3Q2013 comparing to last year. For 9M2013, revenue +18.5%, profit +66.6%. For its full year financial l am expecting it to keep to its double digit growth rate on revenue and profit. On an ongoing basis into next financial year, the only revenue segment to eyeballing for potential de-growth is on Distribution as revenue from Australia can be expected to slowing down further. Its annual dividend is only at 2.0% so Tat Hong is a growth stock.

I have added GRP 1 lot in this week under Cash portfolio so l have 11 lots of total holding of it now.

CM Pacific reported full year financial of revenue +110% and profit +105%. This is an impressive set of results but its share price comes under selling pressure in this week as l suspect investors are expecting a special dividend or a higher final dividend rate. l have invested into CM Pacific 4 lots this week under Cash portfolio. Its annual dividend rate of 6.1% is quite attractive indeed A good stock to invest for passive income stream if bear market decides to pay a visit, in the coming weeks or months.

l have invested into Perennial China Retail Trust 1 lot under Cash portfolio this week. Will accumulate Perennial if its share price weakens as revenue (and profit) will continue to gushing in for year 2013.

Portfolio walk since previous posting :-

+$1,024 Total Returns as of 1 Mar

+$63 Gain on sales of Duty Free and Singapore Shipping Corpn

-$103 Unrealised positions worsened

+$984 Total Returns as of 8 Mar

previous posting :- Cash - Closing Status 1 Mar

Just realized that Duty Free pays a very small dividend rate of $0.0025 when it announced 4Q2012 results last year. Based on my 2 lots holding of Duty Free, the expected dividend amount will be $5 ($0.0025 x 2 lots). So this week l have decided to collect an advance dividend from Duty Free when l sold it away for a gain of $25 or a dividend yield of 2.9% based on my invested funds in it. l am hoping to re-invest into Duty Free when its share price is at a lower level as its current annual dividend yield is at 5.1%.

Invested into Tat Hong 1 lot this week under Cash portfolio. Its 9M2013 is quite good though its biggest revenue segment on Distribution came in softer at -7% in 3Q2013 comparing to last year. For 9M2013, revenue +18.5%, profit +66.6%. For its full year financial l am expecting it to keep to its double digit growth rate on revenue and profit. On an ongoing basis into next financial year, the only revenue segment to eyeballing for potential de-growth is on Distribution as revenue from Australia can be expected to slowing down further. Its annual dividend is only at 2.0% so Tat Hong is a growth stock.

I have added GRP 1 lot in this week under Cash portfolio so l have 11 lots of total holding of it now.

CM Pacific reported full year financial of revenue +110% and profit +105%. This is an impressive set of results but its share price comes under selling pressure in this week as l suspect investors are expecting a special dividend or a higher final dividend rate. l have invested into CM Pacific 4 lots this week under Cash portfolio. Its annual dividend rate of 6.1% is quite attractive indeed A good stock to invest for passive income stream if bear market decides to pay a visit, in the coming weeks or months.

l have invested into Perennial China Retail Trust 1 lot under Cash portfolio this week. Will accumulate Perennial if its share price weakens as revenue (and profit) will continue to gushing in for year 2013.

Portfolio walk since previous posting :-

+$1,024 Total Returns as of 1 Mar

+$63 Gain on sales of Duty Free and Singapore Shipping Corpn

-$103 Unrealised positions worsened

+$984 Total Returns as of 8 Mar

previous posting :- Cash - Closing Status 1 Mar

Sunday 3 March 2013

SRS - Closing Status 1 Mar

Sold away my holding in New Toyo 2 lots in this week under SRS portfolio at break even (minimal loss of -$1). It reported lower revenue and profit comparing to last year for quarter 4. l will look at New Toyo performance at half time in 2013 to see if it is worth investing in this company going forward.

In this week l have also added GRP 21 lots for my SRS portfolio. At half time, revenue was flat +1.0% and profit +17.1%. GRP declared an interim dividend of $0.05 ($0.01 + special $0.04). Its XD date in not known yet. And if it maintain final dividend at $0.01 then dividend yield will be 17.6% based on my investment cost in it.

Also for my SRS portfolio l have invested into GLP (Global Logistic Properties) 5 lots in this week. Government of Singapore Investment Corp. (GIC) recently reduced its stake in GLP to 37% from 49%. This is part of GIC rebalancing of its holdings so l reckon there is really nothing fundamentally wrong with GLP.

Portfolio walk since previous posting :-

+$5,527 Total Returns as of 22 Feb

-$1 Loss on sales of New Toyo

-$215 Unrealised positions worsened

+$5,311 Total Returns as of 1 Mar

previous posting :- SRS - Closing status 22 Feb

In this week l have also added GRP 21 lots for my SRS portfolio. At half time, revenue was flat +1.0% and profit +17.1%. GRP declared an interim dividend of $0.05 ($0.01 + special $0.04). Its XD date in not known yet. And if it maintain final dividend at $0.01 then dividend yield will be 17.6% based on my investment cost in it.

Also for my SRS portfolio l have invested into GLP (Global Logistic Properties) 5 lots in this week. Government of Singapore Investment Corp. (GIC) recently reduced its stake in GLP to 37% from 49%. This is part of GIC rebalancing of its holdings so l reckon there is really nothing fundamentally wrong with GLP.

Portfolio walk since previous posting :-

+$5,527 Total Returns as of 22 Feb

-$1 Loss on sales of New Toyo

-$215 Unrealised positions worsened

+$5,311 Total Returns as of 1 Mar

previous posting :- SRS - Closing status 22 Feb

Cash - Closing Status 1 Mar

In this week for my Cash portfolio l have made several investments and divestments, as listed below :-

Assuming that SGX's next dividends rate is at $0.04 for XD around 30 April then based on my 1 lot holding in it then the expected dividend amount is $40. In this week l have sold it away for a profit of $61 so it is as good as l have collected its dividends in advance.

Invested into GLP (Global Logistic Properties) 1 lot but as it is a growth stock so l have eyed an exit selling price for a returns which is better than bank deposit interest rate. I have sold it away within the same week for a profit of $36 (1.3% yield). On the next day, Government of Singapore Investment Corp. (GIC) reduced its stake in GLP to 37% from 49%. This is part of GIC rebalancing of its holdings so l reckon there is really nothing fundamentally wrong with GLP.

CDW reported a strong set of results this week to end full year on Revenue +13.5% and Profit +143.1%. In this week l have invested in CDW 22 lots. A higher final dividend rate of $0.007 has been declared which is likely to XD on 3 May (tentative announcement on 3 Apr). If l am stuck with it in a bear market then based on my investment cost in it and historical total dividend in past calendar years (2006-2012), l am expect a range of dividend of around 2% - 6%. I am attracted to its current dividend of $0.007 but l must remember that CDW is likely to turn in lower revenue and profit in FY 2013 so l do not wish to holding on to it for a longer period of time. I do hope to be able to divest it all away soon.

Singapore Shipping Corp (Sp Ship) announced a set of soft results for Qtr 3 on 4 Feb. but its share price was not badly affected by it. As of 9M2013 its revenue was flat at +2% and profit +42.3% (because of successful insurance claim). l will not expect Sp Ship to report a profitable Qtr 4 looking at the costs and expenses which are escalating. At full time, l do expect revenue to continue staying at flat growth rate; and profit to stay almost the same growth rate as in 9M2013. For this week l have invested into Sp Ship 10 lots. It pays dividends only once in a year and have been quite stable at $0.01 which is 4.24% yield based on my invested costs in it.

Added GRP 10 lots in this week. At half time, revenue was flat +1.0% and profit +17.1%. GRP declared an interim dividend of $0.05 ($0.01 + special $0.04). Its XD date in not known yet. And if it maintain final dividend at $0.01 then dividend yield will be 17.6% based on my investment cost in it.

Also in this week l have bought into Duty Free International 2 lots. Atlan Holding is Duty Free shareholder at 81%. Malaysian billionaire, Vincent Tan has deemed interest in Duty Free via his holding in Berjaya Group which is controlling 25% of Atlan Holding. Its 9M2013 results have been good though could have been better if not for the increases in certain expenses categories. Using 3Q2012 running rate Duty Free should be able to hold its financials growth rates in 9M2013 at full time.

Portfolio walk since previous posting :-

+$1,913 Total Returns as of 22 Feb

+$97 Gain on sales of SGX and GLP

-$986 Unrealised positions worsened

+$1,024 Total Returns as of 1 Mar

previous posting :- Cash - Closing Status 22 Feb

Assuming that SGX's next dividends rate is at $0.04 for XD around 30 April then based on my 1 lot holding in it then the expected dividend amount is $40. In this week l have sold it away for a profit of $61 so it is as good as l have collected its dividends in advance.

Invested into GLP (Global Logistic Properties) 1 lot but as it is a growth stock so l have eyed an exit selling price for a returns which is better than bank deposit interest rate. I have sold it away within the same week for a profit of $36 (1.3% yield). On the next day, Government of Singapore Investment Corp. (GIC) reduced its stake in GLP to 37% from 49%. This is part of GIC rebalancing of its holdings so l reckon there is really nothing fundamentally wrong with GLP.

CDW reported a strong set of results this week to end full year on Revenue +13.5% and Profit +143.1%. In this week l have invested in CDW 22 lots. A higher final dividend rate of $0.007 has been declared which is likely to XD on 3 May (tentative announcement on 3 Apr). If l am stuck with it in a bear market then based on my investment cost in it and historical total dividend in past calendar years (2006-2012), l am expect a range of dividend of around 2% - 6%. I am attracted to its current dividend of $0.007 but l must remember that CDW is likely to turn in lower revenue and profit in FY 2013 so l do not wish to holding on to it for a longer period of time. I do hope to be able to divest it all away soon.

Singapore Shipping Corp (Sp Ship) announced a set of soft results for Qtr 3 on 4 Feb. but its share price was not badly affected by it. As of 9M2013 its revenue was flat at +2% and profit +42.3% (because of successful insurance claim). l will not expect Sp Ship to report a profitable Qtr 4 looking at the costs and expenses which are escalating. At full time, l do expect revenue to continue staying at flat growth rate; and profit to stay almost the same growth rate as in 9M2013. For this week l have invested into Sp Ship 10 lots. It pays dividends only once in a year and have been quite stable at $0.01 which is 4.24% yield based on my invested costs in it.

Added GRP 10 lots in this week. At half time, revenue was flat +1.0% and profit +17.1%. GRP declared an interim dividend of $0.05 ($0.01 + special $0.04). Its XD date in not known yet. And if it maintain final dividend at $0.01 then dividend yield will be 17.6% based on my investment cost in it.

Also in this week l have bought into Duty Free International 2 lots. Atlan Holding is Duty Free shareholder at 81%. Malaysian billionaire, Vincent Tan has deemed interest in Duty Free via his holding in Berjaya Group which is controlling 25% of Atlan Holding. Its 9M2013 results have been good though could have been better if not for the increases in certain expenses categories. Using 3Q2012 running rate Duty Free should be able to hold its financials growth rates in 9M2013 at full time.

Portfolio walk since previous posting :-

+$1,913 Total Returns as of 22 Feb

+$97 Gain on sales of SGX and GLP

-$986 Unrealised positions worsened

+$1,024 Total Returns as of 1 Mar

previous posting :- Cash - Closing Status 22 Feb

Saturday 2 March 2013

CPF - Closing Status 1 Mar

Invested into SembCorp Industries 2 lots this week under my CPF portfolio. Its share price dropped by 4% after it reported a 7% drop in profit. Majority of its profit is from Marine which fared badly (lowered by 28%!) because of margin squeeze. The rising star in its business mix is Utilities which has a profit CAGR of 20%. Its 15 cents dividends generates a 2.87% of returns over my invested costs and is almost par to CPF 2.50% annual interest rate.

-$59 Unrealised positions worsened

previous journals :- CPF - Closing Status 22 Feb

-$4,672 Total Returns as of 22 Feb

-$59 Unrealised positions worsened

-$4,731 Total

Returns as of 1 Mar

previous journals :- CPF - Closing Status 22 Feb

Subscribe to:

Posts (Atom)