I have re-invested into SGX twice this week at 1 lot each time under Cash portfolio. In the same week l have decided to reduce my holding in it to 1 lot. The 1 lot which l have divested was at a nett gain of $32 which is around 79% of its recent dividend which went XD this week and payment will happen on 2 May. So l have collected total of $63 dividends (nett gain last week $31 + current week $32) in advance. For the remaining l lot holding in it l am hoping to be able to divesting it away at break even. Not that l have given up on SGX but l am hoping to re-invest into it at a lower share price level. SGX will always be my radar as a favorite stock to invest in.

l have divested SPH 1 lot this week from my Cash portfolio at nett gain of $68. This is as good as collecting its $70 (1 lot x dividend rate $0.07) dividend in advance; it is going XD on 7 May and its scheduled payment is on 23 May.

Managed to get into Duty Free 3 lots this week at lower price level after having divested it away the previous week at break even. 4Q2013 results was an "interesting" one. Gross profit margin was unchanged at 29.9% comparing to 4Q2012 (at 30.0%) but its comment on its performance by account line somehow clouded its true operation efficiency and profitability. Higher revenue was said due to combination of higher selling price and higher volume in its Duty Free business segment (which is 97% of total business); so why GP% was flat? Change in inventories is positive amount so it is a "gain" item and it explained it as due to timing difference in purchases and consumption of inventories as closing inventories as of 4Q2013 was much higher. I reckon it is more appropriate to explain the change (in value) of inventories on the aspects of forex and stock valuation basis and not on the vague and general basis of timing. Inventories purchased and material consumed was much higher due to overall increase in purchase volume in order to enjoy better purchasing terms from suppliers - l am totally lost here as wouldn't it be better explained that it was in line with higher revenue? By better purchasing terms l guess this means better credit payment term as in the balance sheet it explained higher inventories due to increase in purchase quantity coupled with increase in cost of purchases. No details given on Donations of $3mil. My investment costs in Duty Free for 3 lots was for a small amount at $1.2k and will always be at this costs level in order to contain any potential investment risk in it.

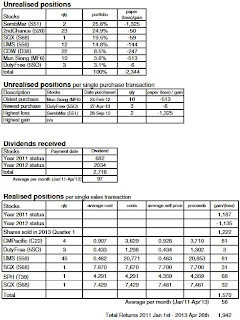

Portfolio walk since previous posting :-

+$1,693 Total Returns as of 19 Apr

+$100 Gain on sales of SGX and SPH

+$149 Unrealised positions improved

+$1,942 Total Returns as of 26 Apr

Previous posting :- Cash - Closing Status 19 Apr

l have divested SPH 1 lot this week from my Cash portfolio at nett gain of $68. This is as good as collecting its $70 (1 lot x dividend rate $0.07) dividend in advance; it is going XD on 7 May and its scheduled payment is on 23 May.

Managed to get into Duty Free 3 lots this week at lower price level after having divested it away the previous week at break even. 4Q2013 results was an "interesting" one. Gross profit margin was unchanged at 29.9% comparing to 4Q2012 (at 30.0%) but its comment on its performance by account line somehow clouded its true operation efficiency and profitability. Higher revenue was said due to combination of higher selling price and higher volume in its Duty Free business segment (which is 97% of total business); so why GP% was flat? Change in inventories is positive amount so it is a "gain" item and it explained it as due to timing difference in purchases and consumption of inventories as closing inventories as of 4Q2013 was much higher. I reckon it is more appropriate to explain the change (in value) of inventories on the aspects of forex and stock valuation basis and not on the vague and general basis of timing. Inventories purchased and material consumed was much higher due to overall increase in purchase volume in order to enjoy better purchasing terms from suppliers - l am totally lost here as wouldn't it be better explained that it was in line with higher revenue? By better purchasing terms l guess this means better credit payment term as in the balance sheet it explained higher inventories due to increase in purchase quantity coupled with increase in cost of purchases. No details given on Donations of $3mil. My investment costs in Duty Free for 3 lots was for a small amount at $1.2k and will always be at this costs level in order to contain any potential investment risk in it.

Portfolio walk since previous posting :-

+$1,693 Total Returns as of 19 Apr

+$100 Gain on sales of SGX and SPH

+$149 Unrealised positions improved

+$1,942 Total Returns as of 26 Apr

Previous posting :- Cash - Closing Status 19 Apr