In this week for my SRS portfolio, l have increased my holding in AIMS AMP Industrial Reit 1 lot. But in the same week l have decided to sell all 4 lots away for a nett gain of $119. Assuming that the next dividend rate is same as last year at $0.025 and also having same XD as last year on 30 July so l will get 4 lots x dividend rate $0.025 = $100 dividend amount. The nett gain of $119 is better than the expected dividend amount and l have already collected it in advance, now.

Divested UMS 5 lots at a nett gain of $68 within one week of investment period. I could not resist for doing so because the nett gain $68 is better than expected dividend amount of $50 (5 lots x dividend rate $0.01). And also l can collect it ahead of its XD date 9 July and payment date 26 July. Anyway, l have re-invested into UMS 21 lots in this week. Its recent business outlook seems okay so l do not mind getting stuck investing in it when its share price starting to drift lower, possibly.

Divested K1 Ventures 10 lots within one week of investment in it for a nett gain of $24 or 1.4% yield , which is far much better than bank deposit rate within such a short investment period. Looking forward to re-invest into K1 Ventures at lower share price levels.

Divested SingPost 6 lots at a nett gain of $118 within three weeks of investment period. The nett gain $118 is around 78% of the dividend amount of $150 (6 lots x dividend rate $0.025 x 78%). Even though the nett gain amount is lower but its a 1.5% yield which is better than bank deposit rate within a rather short investment period. And also l have collected its dividend in advance as it will XD on 2 July and payment date 15 July. Will re-invest into SingPost at lower share price levels.

CDL Hospitality Trusts share price dropped further in this week so l have increased my holding in it from 1 lot to 2 lots now. If l am ever stuck with my investment in it l will have no regrets as l will consider it a good problem to have due to its reasonably good dividend yield of around 6.3% based on my investment costs in it.

Added Frasers Centrepoint Trust 1 lot in this week so my total holding in it now at 2 lots. If l am stuck with this investment then l can still expect an annual dividend yield 5.3% which is much better than bank deposit rate.

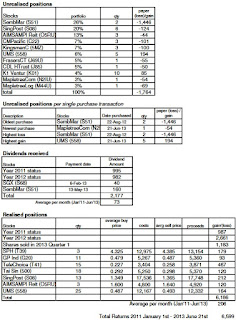

Portfolio walk since previous posting :-

+$6,599 Total Returns as of 21 June

+$329 Gain on sales of UMS, AIMS AMP Reit, SingPost and K1 Ventures

+$16 Unrealised positions improved

+$6,944 Total Returns as of 28 June

previous posting :- SRS - Closing status 21 June

Divested UMS 5 lots at a nett gain of $68 within one week of investment period. I could not resist for doing so because the nett gain $68 is better than expected dividend amount of $50 (5 lots x dividend rate $0.01). And also l can collect it ahead of its XD date 9 July and payment date 26 July. Anyway, l have re-invested into UMS 21 lots in this week. Its recent business outlook seems okay so l do not mind getting stuck investing in it when its share price starting to drift lower, possibly.

Divested K1 Ventures 10 lots within one week of investment in it for a nett gain of $24 or 1.4% yield , which is far much better than bank deposit rate within such a short investment period. Looking forward to re-invest into K1 Ventures at lower share price levels.

Divested SingPost 6 lots at a nett gain of $118 within three weeks of investment period. The nett gain $118 is around 78% of the dividend amount of $150 (6 lots x dividend rate $0.025 x 78%). Even though the nett gain amount is lower but its a 1.5% yield which is better than bank deposit rate within a rather short investment period. And also l have collected its dividend in advance as it will XD on 2 July and payment date 15 July. Will re-invest into SingPost at lower share price levels.

CDL Hospitality Trusts share price dropped further in this week so l have increased my holding in it from 1 lot to 2 lots now. If l am ever stuck with my investment in it l will have no regrets as l will consider it a good problem to have due to its reasonably good dividend yield of around 6.3% based on my investment costs in it.

Added Frasers Centrepoint Trust 1 lot in this week so my total holding in it now at 2 lots. If l am stuck with this investment then l can still expect an annual dividend yield 5.3% which is much better than bank deposit rate.

Portfolio walk since previous posting :-

+$6,599 Total Returns as of 21 June

+$329 Gain on sales of UMS, AIMS AMP Reit, SingPost and K1 Ventures

+$16 Unrealised positions improved

+$6,944 Total Returns as of 28 June

previous posting :- SRS - Closing status 21 June