Donated $100 to Bone Marrow Donor Programme last Sunday evening.

Reduced Cache Logistics Trust 1 lots in this week under Cash portfolio as part of usual portfolio re-balancing for $24 nett gain; total holding in it now at 2 lots. In its recent 3Q2013 financial results; DPU slightly lowered by 0.8% due to higher number of issued units. NPI higher by 8.5% for 3Q2013. Property expenses gone up 27.7% from Qtr 2 to Qtr 3 due to one off reversal of expense accrual in Qtr 2. As of end Qtr 3, its NAV was valued at $0.97 but Mr Market believes that it is worth more with its Friday closing price at $1.115. No debt re-financing requirement till 2015. 70% debts hedged by way of fixed interest rate swaps. Its $375 mil secured term loan (includes $62 mil undrawn) are well spread out across 19 international banks. Continued to maintain a portfolio occupancy at 100% in 3Q2013. No lease expiry renewal risk for the remaining months of 2013. And only 3% of total GFA lease to be renewed in year 2014. Over 85% of GFA taken up by MNCs and government entities.

Reduced GRP Ltd 20 lots in this week as part of usual portfolio re-balancing for $90 nett gain; total holding in it now at 19 lots. For its 2013 financial results, revenue -2.3% mainly due to lower non recurring projects completed in last year for its Measuring Instrument segment which also impacted profit. Profit -30.3%. Lower other income due to one time gain for the disposal of its China subsidiary in 2012. It recently did a rights cum warrants issue for the required funding to develop and manage properties in Myanmar. The rights cum warrants issue was 157.8% subscribed.

Re-invested into Duty Free 3 lots in this week under Cash portfolio. For its 2Q2014 financial results, revenue -1.3%, profit -65.5%. Profit lowered mainly due to decrease in revenue, higher net foreign exchange loss and rental of premises of RM5.9 mil and RM 3.0 mil respectively. To improve operational efficiency, it recently completed an internal reorganization exercise and disposal of its shareholding in its so called Border Town and airport businesses and Down Town businesses.

Added Tee International 10 lots in this week under Cash portfolio. Total holding in it now at 45 lots. Tee Intl delivered mix financial results for 1Q2014; revenue +ve 24% driven by ongoing and completed engineering projects and profit -ve 62% due to higher administrative expenses and higher opex. Higher administrative expenses was due to one off bonus payment to employees and higher staff costs and headcount in line with its business and operations expansion. Giving extra bonuses is a good thing to do as it motivates employees which is in recognition of their hard works. Higher opex due to unrealized forex losses that resulted from the depreciation of the MYR against the SGD. It is in net cash used at the moment mainly due to cash received from receivables net off payment to trade payables, interest and income tax expenses and decrease in development properties. Its chief executive & managing director, Mr Phua has 51% shareholding in Tee Intl as shown in the 2013 annual report so one can be well assured that he will run this company with very much more care and growing it at the same time. Recently, it has signed an MOU with Loxley Public Company, a public company listed on the Stock Exchange of Thailand to explore opportunities in renewable energy business and related activities in the Indochina region - Myanmar, Laos DPR, Vietnam, Thailand and Cambodia.

Reduced HPH Trust 2 lots in this week as part of usual portfolio re-balancing for $57 nett gain; total holding in it now at 4 lots. Attractive valuation after recent share price correction. Its 3Q2013 financial results did not go well with investors but l do not think it is justified. Its 3Q2013 revenue and profit was +1% and -2% respectively versus last year <--- flat results. A flat financial results is quite admirable when the world economy is still in turmoil and in spite of the depressed shipping industry which continue to stall freight rate recovery at the moment. It is in Net Current Liabilities status as of end Sept'13 but overall still at Net Assets status; due to timing of US$3.6 billion term loan facility agreement for the refinancing of the existing facilities which was signed in late Sept'13. It is still in free cash flow status. Higher profit from new acquired Yantian container terminals was partially offset by lower profit in Hongkong international terminals. Its share price dropped to a 52 weeks low recently at $0.755 (11 Dec) which is really absurb. Its end of Sept'13 NAV at HKD 7.41 (approx. SGD 1.20).

Divested away Sabana Reit 1 lot in this week for $25 nett gain. Per its recent 3Q2013 financial results, NPI +4.6%, income available for distribution +3.7%, DPU +1.7%. Its Friday closing price at $1.075 is par to its end Qtr 3 NAV of $1.08. Its new purchase high-tech industrial building in Chai Chee Lane will increase its income stream even though it has 50% vacancy. Of the 5 master leases expired on 25 Nov, it renewed 1 master lease and took over direct management of 4 other properties. Lease expiring in 2014 is at 8.7% of (3Q2013) gross revenue. As of end Qtr 3, its gearing was quite high at 37.5%; about 97% of its total debt was at fixed rates and this reduces the impact of fluctuations in profit rates on the distributable income. In mid-Nov'13 it secured a new 3-year revolving loan called Commodity Murabaha Facility of up to S$48.0 mil.

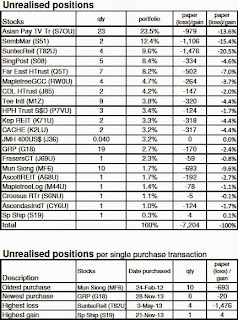

Portfolio walk since previous posting :-

+$863 Total Returns as of 20 December

+$195 Nett Gain on sales of HPH Trust, Sabana Reit, GRP, Cache Logistics

-$100 Donations to Bone Marrow Donor Programme

+$1,002 Unrealised positions improved

+$1,961 Total Returns as of 27 December

Previous posting :- Cash - Closing Status 20 Dec

Remarks :- Profits locked in to-date $11,450 / year 2013 $8,581

Reduced Cache Logistics Trust 1 lots in this week under Cash portfolio as part of usual portfolio re-balancing for $24 nett gain; total holding in it now at 2 lots. In its recent 3Q2013 financial results; DPU slightly lowered by 0.8% due to higher number of issued units. NPI higher by 8.5% for 3Q2013. Property expenses gone up 27.7% from Qtr 2 to Qtr 3 due to one off reversal of expense accrual in Qtr 2. As of end Qtr 3, its NAV was valued at $0.97 but Mr Market believes that it is worth more with its Friday closing price at $1.115. No debt re-financing requirement till 2015. 70% debts hedged by way of fixed interest rate swaps. Its $375 mil secured term loan (includes $62 mil undrawn) are well spread out across 19 international banks. Continued to maintain a portfolio occupancy at 100% in 3Q2013. No lease expiry renewal risk for the remaining months of 2013. And only 3% of total GFA lease to be renewed in year 2014. Over 85% of GFA taken up by MNCs and government entities.

Reduced GRP Ltd 20 lots in this week as part of usual portfolio re-balancing for $90 nett gain; total holding in it now at 19 lots. For its 2013 financial results, revenue -2.3% mainly due to lower non recurring projects completed in last year for its Measuring Instrument segment which also impacted profit. Profit -30.3%. Lower other income due to one time gain for the disposal of its China subsidiary in 2012. It recently did a rights cum warrants issue for the required funding to develop and manage properties in Myanmar. The rights cum warrants issue was 157.8% subscribed.

Re-invested into Duty Free 3 lots in this week under Cash portfolio. For its 2Q2014 financial results, revenue -1.3%, profit -65.5%. Profit lowered mainly due to decrease in revenue, higher net foreign exchange loss and rental of premises of RM5.9 mil and RM 3.0 mil respectively. To improve operational efficiency, it recently completed an internal reorganization exercise and disposal of its shareholding in its so called Border Town and airport businesses and Down Town businesses.

Added Tee International 10 lots in this week under Cash portfolio. Total holding in it now at 45 lots. Tee Intl delivered mix financial results for 1Q2014; revenue +ve 24% driven by ongoing and completed engineering projects and profit -ve 62% due to higher administrative expenses and higher opex. Higher administrative expenses was due to one off bonus payment to employees and higher staff costs and headcount in line with its business and operations expansion. Giving extra bonuses is a good thing to do as it motivates employees which is in recognition of their hard works. Higher opex due to unrealized forex losses that resulted from the depreciation of the MYR against the SGD. It is in net cash used at the moment mainly due to cash received from receivables net off payment to trade payables, interest and income tax expenses and decrease in development properties. Its chief executive & managing director, Mr Phua has 51% shareholding in Tee Intl as shown in the 2013 annual report so one can be well assured that he will run this company with very much more care and growing it at the same time. Recently, it has signed an MOU with Loxley Public Company, a public company listed on the Stock Exchange of Thailand to explore opportunities in renewable energy business and related activities in the Indochina region - Myanmar, Laos DPR, Vietnam, Thailand and Cambodia.

Reduced HPH Trust 2 lots in this week as part of usual portfolio re-balancing for $57 nett gain; total holding in it now at 4 lots. Attractive valuation after recent share price correction. Its 3Q2013 financial results did not go well with investors but l do not think it is justified. Its 3Q2013 revenue and profit was +1% and -2% respectively versus last year <--- flat results. A flat financial results is quite admirable when the world economy is still in turmoil and in spite of the depressed shipping industry which continue to stall freight rate recovery at the moment. It is in Net Current Liabilities status as of end Sept'13 but overall still at Net Assets status; due to timing of US$3.6 billion term loan facility agreement for the refinancing of the existing facilities which was signed in late Sept'13. It is still in free cash flow status. Higher profit from new acquired Yantian container terminals was partially offset by lower profit in Hongkong international terminals. Its share price dropped to a 52 weeks low recently at $0.755 (11 Dec) which is really absurb. Its end of Sept'13 NAV at HKD 7.41 (approx. SGD 1.20).

Divested away Sabana Reit 1 lot in this week for $25 nett gain. Per its recent 3Q2013 financial results, NPI +4.6%, income available for distribution +3.7%, DPU +1.7%. Its Friday closing price at $1.075 is par to its end Qtr 3 NAV of $1.08. Its new purchase high-tech industrial building in Chai Chee Lane will increase its income stream even though it has 50% vacancy. Of the 5 master leases expired on 25 Nov, it renewed 1 master lease and took over direct management of 4 other properties. Lease expiring in 2014 is at 8.7% of (3Q2013) gross revenue. As of end Qtr 3, its gearing was quite high at 37.5%; about 97% of its total debt was at fixed rates and this reduces the impact of fluctuations in profit rates on the distributable income. In mid-Nov'13 it secured a new 3-year revolving loan called Commodity Murabaha Facility of up to S$48.0 mil.

Portfolio walk since previous posting :-

+$863 Total Returns as of 20 December

+$195 Nett Gain on sales of HPH Trust, Sabana Reit, GRP, Cache Logistics

-$100 Donations to Bone Marrow Donor Programme

+$1,002 Unrealised positions improved

+$1,961 Total Returns as of 27 December

Previous posting :- Cash - Closing Status 20 Dec

Remarks :- Profits locked in to-date $11,450 / year 2013 $8,581