Reduced GRP Ltd 7 lots in this week as part of usual portfolio re-balancing for $45 nett gain; total holding in it now at 11 lots. For its 2013 financial results, revenue -2.3% mainly due to lower non recurring projects completed in last year for its Measuring Instrument segment which also impacted profit. Profit -30.3%. Lower other income due to one time gain for the disposal of its China subsidiary in 2012. It recently did a rights cum warrants issue for the required funding to develop and manage properties in Myanmar. The rights cum warrants issue was 157.8% subscribed.

Added Mapletree Greater China Commercial Trust 2 lots in this week; total holding of it now at 7 lots. It just released 3Q2014 (1 Oct'13 to 31 Dec'13) financial results and made comparisons against forecast made during IPO launch. Achieved higher NPI +13.2%. Available distributable income +16.6%. Its NAV as of end Dec'13 was at $0.943 and its last done share price on this Friday was at a discount to NAV at $0.81. Earliest debt expiry is in year 2015 and is well staggered into year 2018 at average 33% each year. Borrowings interest rate for 71% of total debt fixed till year 2015. Portfolio occupancy rate at 97.9% as of end Dec'13. 89% of expiring leases in current financial year have been renewed or re-let. To ensure stability of S$ distributable income, it has hedged 100% of HK$ distributable income for Year 1 and 90% for Year 2. In addition, it has progressively converted CNY distributable income to SGD. Its share price dropped to its new 52 weeks low on Tuesday this week at $0.785. And if we are truly in bear market now then its stock price recovery in this week will be stalled but any share price weakness in it will be a good opportunity to serious minded investors to get into it.

Portfolio walk since previous posting :-

+$3,473 Total Returns as of 17 January

+$45 Nett Gain on sales of GRP

-$604 Unrealised positions worsened

+$2,914 Total Returns as of 24 January

Previous posting :- Cash - Closing Status 17 Jan

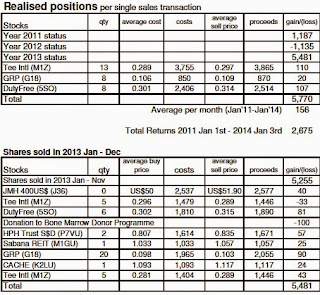

Remarks :- Profits locked in to-date $12,077 / year 2014 $584