previous :- SRS - Closing Status 23 Dec

Donation

Blog Archive

Saturday 31 December 2011

SRS - Closing Status 30 Dec

previous :- SRS - Closing Status 23 Dec

CPF - Closing Status 30 Dec

previous :- CPF - Closing Status 23 Dec

Wednesday 28 December 2011

First Reit hospitals annual valuation

Sunday 25 December 2011

Closing status - 23 Dec

Total returns status improved by $723 over last week which is in line with positive market movement; which are all from unrealized positions.

There are a few stocks which l have intention to sell but their prices are not at break-even yet.

previous post :- Closing status -16 Dec

p/s there will be lesser postings in the coming days and weeks due to busy schedules.

Saturday 24 December 2011

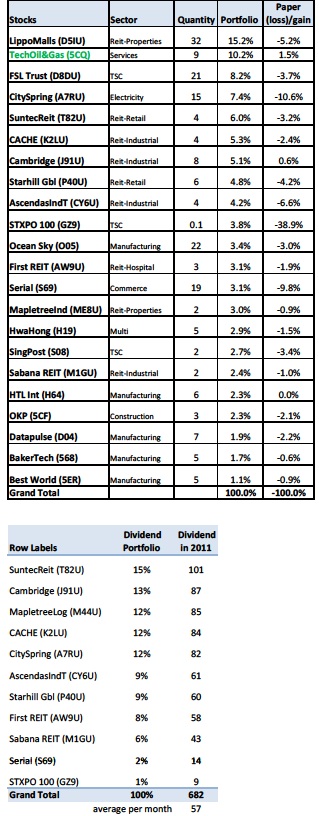

Cash - Closing Status 23 Dec (unrealised stocks status)

Added Tech Oil & Gas 3 lots, FSL Trust 6 lots, LippoMalls 9 lots.

To-sell stocks :- Mapletree Ind, First Reit, Cache, SingPost, Starhill Global, STXPO, Suntec Reit

The stocks counters of five largest funds allocation are still the same as last week's. Figure in bracket was last week's number. Five big stocks in their biggest funds allocation order are :-LippoMalls 15% (12%), CitySpring 7% (8%), Tech Oil & Gas 10% (8%), Suntec Reit 6% (7%) and FSL 8% (7%) totaling to 47% (41%) of the overall Cash portfolio.

Dividend received for year 2011 average of $57 per month. Dividend amount received was not much because of Cash portfolio restructuring only started in 4th week of September month this year (2011). l am still a long way from completing the restructuring. Current cash portfolio would generate dividend amount per month of $620 to $680 if the portfolio is kept the same in year 2012.

previous post :- Cash - Closing Status 16 Dec

SRS - Closing Status 23 Dec (unrealised stocks status)

No change in portfolio under SRS.

FSL was purchased after it went ex-dividend otherwise dividend collected for the year would be higher.

previous :- SRS - Closing Status 16 Dec

Friday 23 December 2011

CPF - Closing Status 23 Dec (unrealised stocks status)

Starhill was purchased after it went ex-dividend otherwise dividend collected for the year would be higher.

previous post :- CPF - Closing Status 16 Dec

Ascendas Park Square Mall by a-iTrust in Bangalore

Ascott - no Reit listing in Malaysia

Thursday 22 December 2011

Ascendas and Accor in Mirvac hotels deal

What's keeping Ascendas from announcing this deal?

>>>>

Accor strengthens its position in Australia and New Zealand

Monday, December 19, 2011

Following this transaction comprising of 6,100 rooms (48 hotels) Accor’s portfolio in those countries will reach 241 hotels, covering the spectrum of hotel segments. The acquisition of Mirvac is fully in line with Accor’s ambitious development strategy announced last September, which includes a target of 40,000 room openings each year in 2012 and 2013, mostly in an asset-light capacity. This operation also demonstrates Accor’s ability to secure its leadership in mature markets, through selective acquisitions. With this transaction, the Group’s network in Australia and New Zealand will reach 241 hotels and 32,500 rooms, covering the spectrum of hotel segments and resulting in a strong presence in each.

“This operation is a major success in a high growth market. With our growth strategy which includes both organic growth and targeted acquisitions such as this one, enabled by our excellent financial situation, I am confident in our capacity to reach our objectives”, said Denis Hennequin, Chairman and Chief Executive Officer. “With an accelerated growth of our offer, stronger brands, unique operational know-how and a dynamic asset management policy, Accor is today aligned with its ambition to become the global reference in the hotel industry”.

The total amount paid by Accor for this acquisition is 195 million euros and includes:

- Mirvac Hotels & Resorts, a management company of 48 hotels (inc. 2 owned hotels), representing 6,100 rooms, for 149 million euros.

- A 21.9% stake in the Mirvac Wholesale Hotel Fund (MWHF), an investment vehicle with ownership of 7 of the hotels, for 46 million euros. Accor and Ascendas, the Singapore real estate developer, are to acquire together Mirvac’s 49.2% stake in MWHF.

The 48 hotels are located mainly in Australia, in key cities such as Sydney, Melbourne, Brisbane and Perth. Four of the hotels are located in New Zealand. The majority of the portfolio will be integrated into Accor’s upscale and midscale brands: Sofitel, Pullman, MGallery, Novotel and Mercure.

Completion of the deal should occur during the first half of 2012, notably after regulatory approvals. The real estate component of the deal will be managed according to the Accor’s asset management policy.

“This agreement is an important step for Accor in Australia & New Zealand, 20 years after our debut in these countries. It offers strong synergies with our existing businesses and further enhances our already leading position”, said Michael Issenberg, Chief Operating Officer Asia Pacific. “At a regional level, along with our pipeline of over 200 hotels committed in Asia Pacific, it demonstrates our continued ability to develop our position in this key region for the Group”.

Following this operation, Accor’s portfolio for the Asia-Pacific region will consist of more than 500 hotels and about 96.000 rooms.

Wednesday 21 December 2011

Ascott to create a Reit in Malaysia

news source :-

Malaysia Business Times

The Ascott Ltd, the world’s largest serviced residence owner-operator, may group its assets in Malaysia and float them on the local bourse.

It may also inject the assets into Ascott Residence Trust (ART), a real estate investment trust (REIT) listed in Singapore to expand the REIT to generate more income for shareholders, said a key official.

“We are toying with several options now. We are still looking at a REIT in Malaysia but the current market is not conducive for us to launch one now,” said Ascott regional general manager for Singapore and Malaysia, Tan Boon Khai.

Singapore-based Ascott, the hospitality arm of CapitaLand Ltd, is the largest international serviced residence operator in Malaysia.

It currently owns and manages Ascott Kuala Lumpur, Somerset Seri Bukit Ceylon and Somerset Ampang.

It also manages Marc Service Suites and Tiffani by i-Zen for their owners.

Over the next five years, Ascott will manage five more properties for third parties, which are under construction. They are Ascott Sentral Kuala Lumpur, Citadines Uplands Kuching, Citadines D’Pulze Cyberjaya, Somerset Puteri Harbour and Somerset Uptown Damansara.

“We were looking at a REIT in Malaysia a few years ago but then crisis hit in 2009. We are bullish on the market but we need to identify our assets. A REIT has to be worth over RM1 billion,” Tan told Business Times.

“Ascott is also expanding ART. If needed, we could also inject the assets in Malaysia into the REIT. There is nothing on the table yet,” he said.

ART is world’s first pan-Asian serviced residence

real estate investment trust, which was listed in March 2006.

The REIT has more than tripled to about S$2.7 billion (RM6.6 billion) since its listing.

It has a portfolio of more than 60 properties in Asia Pacific and Europe.

ART is managed by Ascott Residence Trust Management Ltd, a wholly-owned unit of The Ascott and an indirect wholly-owned subsidiary of CapitaLand.

Its serviced residences are operated under the Ascott, Citadines and Somerset brands and are located in key gateway cities like Beijing, Shanghai, Singapore, Tokyo, London, Paris, Ho Chi Minh City, Jakarta, Manila, Melbourne and Perth.

MCT properties latest valuation

SP AusNet@ dividend payment

Business trust company, SP AusNet@ announced its dividend payment :-

"Securityholders will be pleased that SP AusNet has declared an interim distribution of 4.000 Australian cents per security, with 33.3 per cent fully franked. SP AusNet is on track to deliver a full-year distribution of 8.000 Australian cents per security."

Mapletree Logistics Yen note issue - Moody's Baa1 rating

Refinancing - doing it for the sake of a better future. l shall hold back my adverse views over this for now. Anyway, take it away Mapletree Logistics; the floor is your now.

>>>>>

Mapletree Logistics Trust Management Ltd., the manager of Mapletree Logistics Trust (“MLT”) is pleased to announce that MapletreeLog Treasury Company Pte. Ltd., a wholly-owned subsidiary of MLT, has today issued JPY9 billion (~S$150 million) 10-year fixed rate notes to a long-term financial investor. Priced at a fixed interest rate of 2.71% per annum, the issuance in the current financial environment underscores MLT’s strong credit standing and ready access to the debt capital market.

The JPY9 billion notes are issued under the existing S$1 billion Multi-Currency Medium Term Note (“MTN”) Programme and will mature on 20 December 2021. The notes are priced at a spread of 1.7% above the current 10-year JPY swap rate. The notes are unsecured and have been assigned a rating of Baa1 by Moody’s, the same rating as the corporate family rating of MLT. A copy of the Moody’s press release is attached for information.

The proceeds from the note issuance will be applied towards the refinancing of its JPY loans. Post refinancing, the proportion of MLT’s debt due in 2012 is reduced to about 7% of total debt. The note issuance has also improved the debt maturity profile and diversified the funding sources of MLT.

Mr Richard Lai, Chief Executive Officer of the Manager said, “The success of this issuance is a strong endorsement from our investor, a leading life insurance corporation, of MLT’s financial stability and resilience. We are pleased to have secured long-term funding at such a competitive rate especially given the current volatile global capital market environment.”

MLT has also recently entered into a 5-year bank loan agreement to refinance about JPY1.4 billion of loans (approximately 2% of overall debt) due in 2012. Taken together with this note issuance, MLT’s average debt duration has improved from 3.7 years to 4.5 years, with a more balanced debt maturity profile. In particular, the proportion of debt due in 2012 has been reduced from 14%2 to 7%. Given that MLT has sufficient liquidity from its available credit facilities to meet the remaining debt due next year, the Manager believes that MLT’s near term refinancing risks has been effectively managed.

previous story :- Singapore REITs credit crunch

Tuesday 20 December 2011

FSL (D8DU) - completion of loan refinancing

FSL announced today that :-

".... it has fully drawn down the US$479.6 million 6-year term loan facility and successfully refinanced its outstanding loan balance...."

previous story :-

FSL Trust (D8DU) refinanced

Monday 19 December 2011

DBS Vickers cherry picking

We keep an overall defensive stance but for investors who are expecting

to see some year-end window dressing activities, our picks are high beta

stocks with sound fundamentals like STX OSV, Ezion, Keppel Corp,

SembCorp Industries, Genting and F&N.

REITS remain our defensive sector pick. REITS have outperformed most

sectors YTD. With uncertainties in Europe and risk of slower growth in

major economies not likely to fade away in the near term, REITS will

still be one of our preferred sectors.

Sunday 18 December 2011

Closing status -16 Dec

Total (cash + srs + cpf) unrealised position worsen by $2.2k versus last week as overall market is still very depressed.

Total realised position has gone up by $592 versus last week :- Cash portfolio $25 + SRS portfolio $280 + CPF portfolio $288.

Cash portfolio contributor was from sales of SingTel. I have updated both SRS and CPF portfolios using the statements received from the bank and CDP this week on dividends received in November month for Olam, SGX and SingPost. There will always be lagging effect in updating SRS and CPF portfolios as l would depend on the month-end statements for the nett dividends amount received. Same goes to Cash portfolio as l would depend on the cheques in the mail for updating the dividends received.

previous post :-

Closing status - 09 Dec

Cash - Closing Status 16 Dec (unrealised stocks status)

Added Tech Oil & Gas 4 lots, HTL Int 6 lots, Ocean Sky 22 lots, LippoMalls 9 lots.

Sold SingTel 0.500 lots.

I hope to sell these counters next, which failed the annual dividend target based on a 100% funds allocation test - Mapletree Ind, First Reit, Cache, SingPost, Starhill Global, STXPO, Suntec Reit. Restructuring and reallocation of portfolio is necessary so as to maximize (dividend) returns due to limited funds. Selling these counters now would means suffering losses so, l will wait for better prices.

Most difficult to sell is STXPO of 0.1 lots, which was purchased in June 2008 and from past records which l managed to retrieve it was subject to share consolidation in Dec 2008. Selling STXPO now means a loss of $2.2k! STXPO will be in my to-sell list for the longest time.

Five big stocks in their biggest funds allocation order are LippoMalls 12%, CitySpring 8%, Tech Oil & Gas 8%, Suntec Reit 7% and FSL 7% totaling to 41% of the overall Cash portfolio. Suntec Reit will soon be removed from this five big stocks and be replaced by LippoMalls, CitySpring and Tech Oil & Gas.

previous post :-

Cash - Closing Status 09 Dec

Saturday 17 December 2011

Friday 16 December 2011

Ascott Reit $150m fixed rate notes

Yet another Reit company seeking "refinancing", now it is Ascott Reit.

Refinancing is via the previously approved S$1B Multicurrency Medium Term Note Programme

The principal terms of the Notes are as follows:

Issue Size : S$150,000,000

Issue Price : 100% of the principal amount of the Notes

Interest : 3.80% per annum

Maturity Date : 16 December 2015

The net proceeds arising from the issue of the Notes will be used for the purpose of refinancing the existing borrowings of the Ascott Reit Trustee and/or Ascott Reit and its subsidiaries (the "Group"), financing the general working capital, asset enhancement works and corporate requirements (including acquisitions and investments), or on-lending to the Group.

The Notes will be listed and quoted in the Bonds Market with effect from Monday, 19 December 2011.

The Notes will be in denomination of S$250,000 and the Notes will be traded in trading board lot size of S$250,000.

K-Reit in desperate PR drive?

K-Reit announced its 1st anchor tenant at Chifley Square in Sydney.

It needs many more good news to overcome the negative publicities from the OFC saga recently.

Extract of announcement as below.

>>>

K-REIT Asia Management Limited, as Manager of K-REIT Asia, is pleased to announce its first anchor tenant at 8 Chifley Square in Sydney - Corrs Chambers Westgarth. A leading Australian law firm, the company has pre-committed approximately 87,000 sf of premium office space at 8 Chifley Square in Sydney, Australia, for a 12-year term. This works out to be approximately 40% of the total net lettable area ("NLA") of the building.

This is the first lease for the development, ahead of its completion in the third quarter of 2013. Corrs Chambers Westgarth will be located over levels 9 to 18 of the 30-storey building. The law firm currently has offices in Sydney, Melbourne, Brisbane, and Perth.

Ms Ng Hsueh Ling, CEO of K-REIT Asia Management, said, "The strong pre-commitment level affirms our positive sentiments on the Australian office market. We anticipate healthy demand for the remaining space as 8 Chifley Square appeals to leading corporations which value both the building's prime location and premium quality."

Currently under construction, 8 Chifley Square is located in the heart of Sydney's central business district at the junction of Hunter Street and Elizabeth Street, and will have an estimated 205,700 sf of NLA.

Thursday 15 December 2011

LippoMalls (D5IU) refinancing

Below is the announcement extract :-

Refinancing of Lippo Malls Indonesia Retail Trust's existing borrowings due on 26 March 2012

Further to its announcement dated 28 September 2011 relating to the entering into of a facility agreement to, inter alia, refinance its existing bank borrowings due on 26 March 2012, LMIRT Management Ltd., as manager of Lippo Malls Indonesia Retail Trust ("LMIR Trust", and as manager of LMIR Trust, the "Manager") is pleased to announce that LMIR Trust has, on 13 December 2011, effected a drawdown of S$147,500,000 under the facility agreement and has successfully refinanced its existing bank borrowings. The new facility will be due for repayment 30 months after 13 December 2011.

Stay invested ...

someone wrote this to me :-

"... Your best strategy is to stay invested during downturns that way you can’t miss the bottom of the market and the subsequent gains on the upside.

It is difficult to watch the value of your portfolio drop in a down market, but study after study has shown that staying invested with a well-balanced portfolio is the best strategy.

Will we retest the lows or are we building a base for a new bull rally?

Who cares!

The market is going to do what it is going to do, and timing does not work. Typically staying invested regardless of conditions is a winning strategy for the long term. ...."

Wednesday 14 December 2011

A broken record music by DBS Vickers

DBS Vickers published two industry focus research reports on two consecutive days, 13 Dec and another time on 14 Dec!!!

Dec 13 report :-

Singapore Retail Reits

and here on Dec 14 report :-

Singapore Reits

with very much emphasis on Capitamall Trust (C38U) and Mapletree Commercial Trust (N21U). Noted, DBS Vickers. We hear you loud and clear.

Another publication this week by DBS Vickers promoting these two counters, I will have to be on anti-nausea medication.

WEF-The Financial Development Report 2011

>>>>>

Singapore falls one spot to place 4th in the Index, accompanied by a decrease in overall score. Like Hong

Kong, Singapore exhibits strength in its factors, policies, and institutions. Singapore’s strong institutional (1st)

and business (2nd) environment is reflected in its commitment to contract enforcement (1st), improvement

in human capital (3rd), and low cost of doing business (2nd). Singapore experiences declines in score across all

three financial intermediation pillars: banking financial services (16th), non-banking financial services (12th),

and financial markets (2nd). Of particular significance are the 13-rank declines in both securitization (28th)

and banking system efficiency (14th). Nevertheless, Singapore continues to make access to commercial capital

(2nd) readily available. This is further highlighted by a strong venture capital presence (3rd) and high level of

foreign direct investment (2nd).

Its 2nd rank in the variable Quality of overall infrastructure makes this variable a development advantage, whereas Internet users, on which it ranks 19th, constitutes a development disadvantage for the country.

source :-

World Economic Forum’s 2011 index

K-Reit Asia (K71U) ... the dilution effect

Speak of dilution after rights issue.

Below is an example of its dilution effect on the Director of K-Reit himself.

K-Reit announced today of its Director's (Kevin Wong) direct percentage holdings as below :-

No. of shares held before the change :-

2,888,976 shares or 0.2117%

No. of shares held after the change :-

3,000000 or 0.1188%

SSH of Cambridge (J91U)

Subsidiary company of Franklin Resources, Inc made 5 different announcements today that of its presence in Cambridge is now at 7.04% (from old percentage level 6.13%); resulted from various transactions between 21 Nov to 12 Dec.

Tuesday 13 December 2011

CapitaCommercial Trust (C61U) refinancing

CapitaCommercial Trust (C61U) announced today that it managed to refinance its loan due in 2012 of S$570.0 million. From short term debt expiring soon and now becomes long term debt, probably that's good for liquidity measurement or current ratio. Below is an extract of its announcement.

Due to global economy uncertainty so, in the coming weeks and months, there could be more companies seeking refinancing; before their books close for the quarter or year end.

>>>>>>

Ms. Lynette Leong, Chief Executive Officer of the Manager, said, “We are pleased to have the strong

support and commitment from banks and debt investors notwithstanding the current global economic

uncertainty. As part of our proactive capital management strategy, we have secured total committed

funding of S$650.0 million from banks and the debt capital market to refinance the S$570.0 million term

loan, well ahead of its maturity in March 2012. The balance committed funding will be deployed for

CCT’s corporate funding purposes when the need arises.”

“The current mortgage of Capital Tower will be discharged after refinancing the S$570.0 million term loan

secured on Capital Tower in March 2012 with the new, unsecured facilities. As a result, seven properties

with a total asset value of S$3.9 billion out of CCT’s portfolio of nine properties will be free from

encumbrances. This will provide us with further financial flexibility in managing CCT’s capital and balance

sheet,” added Ms Leong.

Stocks to focus on ...

"... In Singapore, the timing of the latest property measures will likely continue to damp enthusiasm property and related stocks for a while, although leaders like CapitaLand ($2.35 on Friday, down 7), City Developments ($9, down 18) are at important technical supports. Otherwise, based on remarks by Finance Minister Tharman last week, Reits and other high-yielders will likely remain popular with increasingly risk-averse investors. Here, we maintain preference for City Spring (a business trust; 33 cents, unch), Fraser Centrepoint ($1.505, down 1), Mapletree Commercial (87 cents, down half), Parkway Life ($1.76, down 2.5), StarHub ($2.86, up 2), and M1 ($2.41, down 2). Others that we favor are DBS ($12.08, down 22), SembCorp Industries ($4.19, down 16), Keppel Corp ($9.20, down 10), Semb Marine ($3.86, down 12). ..."

Sunday 11 December 2011

Closing status - 09 Dec

Realised positions upped by $296 driven by sales of some counters in the cash portfolio.

Unrealised gone southward again in line with weak market.

Previous posting :

Closing status - 02 Dec

Saturday 10 December 2011

Cash - Closing Status 09 Dec (unrealised stocks status)

Added HwaHong 5 lots, LippoMalls 9 lots, FSL 15 lots.

Sold Noble 2 lots, MacqIntInfra 3 lots, CDL HTrust 2 lots, CapitaComm 2 lots, MappletreeLog 5 lots.

Tested my cash portfolio as of Dec 02 on dividend returns in absolute dividend amount on the assumption of what-if available funds of $10k and also the full 100% allocation of the funds against each stock.

If $10k is in POSB bank savings account, l will get $5 annual interest.

If $10k is spent on goods and services in a year which comes with 7% GST, l will suffer $700 on GST paid.

With 100% of $10k allocation against each stock, the counters which l have sold this week (Noble, MacqIntInfra, CDL HTrust, CapitaComm, MappletreeLog) failed to give me an annual dividend above $800. This $800 is enough to cover the GST amount paid but remaining $100 (in a year) is really too little.

Of these three counters added this week, HwaHong is riskiest (per its 3rd quarter financial statement), what got into me investing in this counter ... OMG. l will continue to monitor it.

previous posting :-

Cash - Closing Status 02 Dec

SRS - Closing Status 09 Dec (unrealised stocks status)

No change on portfolio items.

previous posting :-

http://sgchest.blogspot.com/2011/12/srs-closing-status-02-dec-unrealised.html

CPF - Closing Status 09 Dec (unrealised stocks status)

No change on portfolio items.

previous posting :-

http://sgchest.blogspot.com/2011/12/cpf-closing-status-02-dec-unrealised.html

Friday 9 December 2011

K-Reit subsidiary obtaining financing, why?

has obtained the Loan Facilities secured with a corporate guarantee by

RBC Dexia Trust Services Singapore Limited in its capacity as trustee of

K-REIT Asia.

An aggregate of S$450 million Term Loan Facilities and a S$100 million

Revolving Credit Facility obtained by K-REIT Fin. Company Pte. Ltd. as

borrower ("Loan Facilities") on 8 December 2011.

Thursday 8 December 2011

Ascendasreit (A17U) owns 97 properties to-date

Corporation Road for a purchase consideration of S$99 million from

Corporation Place Limited and the acquisition of 3 Changi Business Park

Vista for a purchase consideration of S$80 million from CBP3 Pte Ltd.

Mr Tan Ser Ping, Executive Director and Chief Executive Officer of the

Manager said, "We are pleased to enhance A-REIT's portfolio in Singapore

with the acquisition of the above two yield accretive assets. The

location and specifications of these properties will further strengthen

A-REIT's market position in the Jurong Lake District and Changi Business

Park area and enhance its operational efficiency."

The acquisitions are expected to have an annualised pro forma financial

effect of an additional 0.10 cents per unit (1) on the distribution per

unit for the financial year ended 31 March 2011.

A-REIT is expected to incur an estimated transaction cost of about

S$1.02 million, which includes S$0.8 million in acquisition fee payable

to the Manager (being 1% of the purchase price). With the above

acquisitions, A-REIT owns a total of 97 properties

Wednesday 7 December 2011

K-Reit Rights Issue results ... within reasonable expectation?

Valid acceptances and excess applications for a total of 1,144,949,780 Rights Units were received as at the close of the Rights Issue on 5 December 2011 (the "Closing Date"), representing approximately 98.73% of the total number of 1,159,694,000 Rights Units to be issued pursuant to the Rights Issue. The balance 14,744,220 Rights Units, representing approximately 1.27% of the Rights Units to be issued under the Rights Issue, will be subscribed by DBS Bank Ltd. and United Overseas Bank Limited, in their capacity as Joint Managers and Underwriters, in equal proportion as set out in the Management and Underwriting Agreement.

Details of the valid acceptances and excess applications received are as follows:

Valid acceptances

Number of Rights Units - 1,094,160,863

% of Total Number of Rights units - 94.35

Excess applications

Number of Rights Units - 50,788,917

% of Total Number of Rights units - 4.38

Total

Number of Rights Units - 1,144,949,780

% of Total Number of Rights units - 98.73

The valid acceptances received include the acceptances by wholly-owned subsidiaries of KCL and KLL, being Keppel Real Estate Investment Pte. Ltd. and K-REIT Asia Investment Pte. Ltd. respectively, of their aggregate entitlements of 885,695,152 Rights Units, which includes the pro rata entitlement of the Manager that was renounced in favour of K-REIT Asia Investment Pte. Ltd., representing approximately 76.37% of the total number of Rights Units to be issued under the Rights Issue.

Keppel Real Estate Investment Pte. Ltd. has also made an application for 12,900,000 Excess Rights Units, representing approximately 1.11% of the total number of Rights Units to be issued under the Rights Issue.

Singapore REITs credit crunch

Link :- http://www.cpf.gov.sg/imsavvy/infohub_article.asp?readid=%7b967180815-11079-4226146935%7d&print=1

DEBT worries are emerging over some high-flying Singapore real estate investment trusts (Reits) which have borrowed heavily at rock-bottom interest rates to add properties to their portfolios.

These Reits have gone on a borrowing spree to make acquisitions offering high rental income, which in turn translates to higher payouts to unit holders.

But debt is now a dirty word in the wake of the growing credit crunch in Europe, which is forcing European banks - a major source of funds for regional borrowers - to scale back on their lending.

These worries have reverberated among investors in Reits.

Since Aug 1, the FTSE ST Reit Index has fallen by 13.2 per cent.

But some Reits have suffered much steeper falls. Suntec Reit has plunged 25.1 per cent, K-Reit has nose-dived 28.5 per cent and Ascott Residence Reit has slumped 16 per cent.

Flagging its concerns recently, credit rating agency Moody's said that while it has a 'stable outlook' for Singapore Reits, the risks are apparent.

'A slowdown in Singapore's GDP growth, coupled with a large supply of new properties coming on-stream, should dampen rental growth, while debt-funded acquisitions have led to increased leverage for several S-Reits,' it noted in a report last week.

Deutsche Bank analysts Elaine Khoo and Gregory Lui noted in a report on Monday that while liquidity is still available in the Singapore dollar bond markets, the spreads have started to trend up.

'Fixed income investors are increasingly focusing on absolute yields, unlike bank financing, which is based purely on credit assessment,' they added.

The yield is also being driven up by competition which S-Reits are facing from Hong Kong giant conglomerates such as Cheung Kong and Wharf that have turned to Singapore to raise funds.

Still, some analysts are confident S-Reits will ride out any credit crunch triggered by the euro zone debt crisis far better than in the global financial crisis three years ago when they were hammered.

'When markets turned the corner in August, the more volatile names such as office and hospitality Reits saw their stock prices falling sharply, with some falling up to 30 per cent on fears of revisiting the sub-prime days,' said Credit Suisse analyst Yvonne Voon in a report last week.

'However, we believe this time, it is going to be different, as we do not expect S-Reits to revisit sub-prime troughs, where some traded down to 0.2 times price-to-book, due to their stronger balance sheet and a generally better economic outlook,' she added.

Separately, CIMB analysts Janice Ding and Tan Siew Ling argued in their analysis of S-Reits debt that the sector is in a much stronger capital position now than it was in 2008.

'After the global financial crisis, S-Reits have drawn on the lessons learnt to take advantage of the low interest rates to lengthen their debt maturities. Most of them do not have major refinancing needs until 2013,' they added.

Short-term debt - the scourge which took S-Reits to their knees three years ago, is only 8 per cent of total debt, down from 38 per cent in June 2008.

They said the biggest threat facing S-Reits is a drop in valuation of their assets which may, in turn, cause their debt-to-asset ratio to soar.

'We stress-test the asset leverage of 15 S-Reits and identify Ascott Residence Trust, Mapletree Logistics Trust, K-Reit and Suntec Reit as the most vulnerable to potential falls in asset value.'

But UBS analysts Michael Lim and Adrian Chua noted that at current price levels, S-Reits offer an attractive yield of 7.1 per cent.

'We expect S-Reits dividend per unit's growth at 1.2 per cent per annum with retail and hospitality Reits leading the growth at 4.4 per cent and 2.4 per cent respectively,' they added.

engyeow@sph.com.sg

Tuesday 6 December 2011

DBS Vickers awed by Starhill Gbl (P40U) KL assets

url :- Timeless appeal

• Malls in prime KL locations, with distinct tenant mix

• Opportunity to increase Lot 10 revenue through AEI

• Maintain BUY and S$0.76 TP

Strong foothold in KL shopping scene. SGREIT’s two retail malls – Starhill Gallery and Lot 10 – have a strong foothold in KL’s prominent Bukit Bintang shopping district. After completing Starhill Gallery’s AEI, its modern iconic facade will cement its crème de la crème position. It has signed on exciting new retailers to refresh and enhance its tenancy mix. Currently, both malls and the new space created at Starhill Gallery are master-tenanted to Katagreen Development, a subsidiary of YTL Corp. until 2016, with option to renew for another three years. Occupancy rates at both malls are >95%.

Lot 10 might be next for AEI, we see only upside. Lot 10 now houses several beauty/spa tenants on the 3rd and 4th floors. But the master tenant could bring in more fashion retailers, including new-to-market brands, which are usually higher yielding tenants. We also see opportunities for the REIT to expand the mall’s NLA by converting carpark space and building new annex blocks.

Making KL a shopping destination. The government’s efforts to rejuvenate Bukit Bintang will have positive impact on the malls. Construction of a new MRT station located adjacent to Lot 10 will start next year, and is expected to be ready in 4-5 years. Plans for covered walkways to link KLCC to Bukit Bintang district will also create >10m sf of retail space to attract more tourists. Completion of this public infrastructure could boost the malls’ accessibility.

Wisma Atria will see similar transformation. AEI works at Wisma Atria will be completed in 3Q12, and underpin FY12 earnings growth. SGREIT is now trading at attractive 0.6x P/BV, and offers 7.4%-7.7% DPU yields for FY11/12.

K-Reit said OFC is once in a blue moon deal

Monday 5 December 2011

Singapore GIC on property spree in Australia?

source : The Australian newspaper

DIRECTORS of $1.7 billion Australian office landlord Charter Hall Office REIT have reached a conditional agreement to privatise it after a consortium of global funds again raised their offer.

Charter Hall Office REIT directors confirmed last night that the Macquarie Group-advised consortium comprising the Government of Singapore Investment Corporation and the Public Sector Pension Investment Board of Canada had agreed to offer unitholders $2.47 per unit plus a 2c per unit special dividend.

The offer for the Australian business equated to $1.23bn.

It excludes proceeds of the $US1.7bn ($1.66bn) sale of the US portfolio, which is expected to be finalised by March when unitholders will vote on the consortium's takeover proposal.

The consortium made its initial approach for the company in August and has twice sweetened its bid after the trust's directors suggested they would not support earlier offers.

However, last night, one Charter Hall Office REIT shareholder said he would not back the deal, as it reflected a 4.2 per cent discount to the net tangible asset backing of $2.60 for the Australian business.

Major shareholders include activist hedge funds led by US-based Orange Capital.

The hedge fund tried to oust Charter Hall as the trust's manager this year in protest against perceived conflicts of interest on corporate governance issues and management fees. Charter Hall Office REIT's shares have been in a trading halt since Friday at $3.42.

The trust's 19 Australian office properties were last valued on the books at $1.9bn.

Among its best assets are 50 per cent stakes in three Sydney buildings: 1 Martin Place, 2 Park St and 2 Market St.

The consortium will buy all units of the trust, excluding the 15 per cent held by headstock Charter Hall group, which will manage the entity as an unlisted wholesale fund should the deal proceed.

As part of the proposal, unitholders would be paid out a 7.2c per unit dividend.

Previous post :-

http://sgchest.blogspot.com/2011/12/mapletreeind-me8u-rights-issue-soon.html

SSH of Starhill (P4OU) selling Orchard Boulevard homes

YTL to start selling luxury homes in Singapore

Dec 05, 2011

YTL Corp may begin selling its luxury home project in downtown Singapore in the first half of 2012, more than four years after buying the site, as the Malaysian developer expands its holdings in Asia. The project, converted from an old apartment building on Orchard Boulevard that the company purchased in 2007, will have 78 units targeting wealthy Asian buyers from countries including China, Indonesia and Malaysia, according to Kemmy Tan, the head of YTL's real estate unit in the city-state.

YTL managing director Francis Yeoh has been expanding outside of Malaysia into the real estate markets in countries, including Japan, China and Singapore to take advantage of Asia's growing affluent property investors. The group also has businesses in utilities and cement. "Wealthy Asian property buyers have now gained more exposure to more sophisticated life-style and design," said Tan, adding that she estimated buyers would probably be willing to pay a 20 per cent premium compared to regular prices for the design by a renowned architect.

The project will be designed by Antonio Citterio, an Italian architect whose work includes the Bulgari Hotel in Milan and Bali and the Ermenegildo Zegna Group's new Milan headquarters, marking his first residential project in Asia. YTL bought the original Westwood Apartments building for S$435 million (RM1.06 billion) in 2007, a record at the time for the purchase of an existing apartment through a so-called en- bloc sale. It had since leased out the units. Tan declined to say how much YTL would sell the units for, which will have areas of between 1,000 and 3,500 sq ft, adding that the average prices of luxury apartments in the area ranged between S$3,800 and S$5,000 a square foot (RM9,300 and RM12,200).

St Regis Residences, a five-minute walk away, was last purchased at S$2,776 (RM6,777) a sq ft in September, while the Marq on Paterson Hill and Orchard Residences, about 1km away, sold homes at more than S$4,000 (RM9,766) a sq ft, government data showed.

The Kuala Lumpur-based company is the biggest shareholder of Starhill Global REIT, a Singapore-based property trust that owns stakes in the city's retail malls such as Ngee Ann City and properties in Tokyo's Roppongi and Daikanyama shopping districts.-Bloomberg

Sunday 4 December 2011

MapletreeInd (ME8U) rights issue soon?

There were recent reports that Mapletree Industrial (and Singapore GIC, too?) is eyeing a portfolio of Australia building properties.

If successful, it will be Mapletree Industrial's first cash call since listed in October 2010.

All suitors have signed a confidentiality agreement to access documents relating to the assets, which are expected to go on the market after Christmas.

>>>>>

source : The Australian newspaper

Fourteen parties, including the cashed-up Singapore-based Mapletree Industrial Trust, have expressed interest in $100 million worth of industrial assets owned by the former MacarthurCook Industrial Trust.

All groups have signed a confidentiality agreement to access documents relating to the assets, which are expected to go on the market after Christmas.

US-based Commonwealth REIT privatised the MacarthurCook trust when it bought the business last year.

Industry sources said other offshore groups interested in the assets could include Aviva, which has plans for an Australian logistics fund, and the Government of Singapore Investment Corporation, which has been active in the market in the past two years. Boutique investment bank Investec also is said to be interested on behalf a South African investor.

Local investors could include 360 Capital Group, which still hopes to float an industrial vehicle, and perhaps Dexus Property Group, which has signalled it intends to increase its industrial portfolio.

One source suggested that, based on early indications of strong demand, the portfolio could fetch up to $120m.

Commonwealth REIT Australia's chief investment officer John Mannix confirmed plans to sell the portfolio of 10 buildings in NSW, Tasmania, Western Australia and Victoria.

Mr Mannix said Commonwealth REIT had repositioned the assets after it acquired MacarthurCook, lifting average occupancy rates from about 80 per cent to more than 90 per cent.

"The buildings are leased to blue-chip tenants like Coles and Woolworths and General Electric," he said.

"We've decided to sell the industrial properties and to use the proceeds to invest in office properties to be consistent with the strategy in the US."

Sources say Commonwealth REIT could be a buyer of the Stockland-owned Exchange Plaza at The Esplanade in Perth. The 31-storey building with views over the Swan River went on the market a week ago, according to a source. The building was independently valued in June at $150m.

"We have come to understand that in Australia we have to look for off-market deals," Mr Mannix said. "In the US, most transactions are listed with agents and done on market."

Mr Mannix was the president and chief investment officer of the US-listed Commonwealth REIT before coming to Australia to guide the expansion of its Australian investment.

The business has bought a Sydney office tower from Investa Property Group at 320 Pitt Street for $193m. The plan is to expand Commonwealth REIT to a billion-dollar platform, and then list it on the ASX or in the US.

"We came to Australia because of the tremendous opportunities here as a result of its linkage with China and the resources boom and growth of this region," said Mr Mannix.

-end-

Cash - Closing Status 02 Dec (unrealised stocks status)

New additions are Datapulse 7 lots, CitySpring 5 lots, Best World 5 lots, Baker Tech 5 lots, LippoMalls 5 lots.

Saturday 3 December 2011

Closing status - 02 Dec

closing status - 25 nov

Accounting for quarterly service charges under CPF investment account of $41 to-date, which was omitted in previous posting but now updated.

Friday 2 December 2011

Cambridge (J91U) caught in the act?

Warchest

There are people wanting to wait for stock market crash so, their war chest of funds sits idle in their normal bank account say, in POSB and DBS savings account with very little interest rate.

POSB and DBS Savings Plus savings account

- first $10k - 0.05% p.a.

- next $90k - 0.05% p.a.

This war chest fund contains funds that are set aside for use when there is superb golden opportunity in the stock market. There are better or higher savings interest rates in other banks e.g. Maybank and Standard Chartered Bank.

Maybank iSAVvy savings account

-below $50k - 0.31% p.a.

- above $50k - 0.39% p.a.

Standard Chartered Bank e$aver savings account

-below $50k - 0.508% p.a.

- above $50k - 0.708% p.a.

Follow think link for the summary :-

http://forums.hardwarezone.com.sg/showthread.php?t=3056583

No use putting the idle funds in fixed deposits as the interest rate will be forfeited when there is a premature withdrawal of the deposits.

Thursday 1 December 2011

FSL Trust (D8DU) refinanced

FSL TRUST secures US$479.6 million 6-year amortising term loan facility

- Existing revolving credit facility will be refinanced with 6-year amortising term loan, extending FSL Trust’s loan maturity to 2017

- Reaffirms unchanged distribution capacity

Mr. Cheong Chee Tham, Senior Vice-President and Chief Financial Officer of FSLTM (FSL Trust Management Pte. Ltd.) said: “The successful completion of the loan facility amidst the challenges in the global financial and shipping markets is testament to the reputation and strength of FSL Trust. With the renewed partnerships with our existing lenders as well as strong support from our new banking partners, FSL Trust can now look forward in confidence and continue to build our business.”

Mr. Philip Clausius, President and Chief Executive Officer of FSLTM said: “We continue to believe in the traditional sale and leaseback structure which underpins FSL’s strategy. Our focus is now to build on the strong foundation of the business and assess all available opportunities to maximise returns for our unitholders.”