The secret to how Popular bookstores stay in business

Lisabel Ting

The Straits Times

Thursday, Dec 11, 2014

Halfway through an hour-long interview with Life!, Popular Holdings chief executive officer Chou Cheng Ngok declares: "I don't read books."

This is ironic, since he runs a large chain of bookstores.

"I read The Economist, Time, Fortune, Forbes, anything that's informative and entertaining," he is quick to point out. "But for me, books are a luxury. You need a quiet spot to sit down and enjoy reading and honestly, I don't have the time."

As Popular celebrates its 90th anniversary this year and holds its annual BookFest@Singapore book and stationery event this weekend, it is clear that the man at its helm is no book-shunning ignoramus. Mr Chou has his eye on the future as the bookstore industry sails into choppy waters, and is charting a course through the rough tides with a steady hand.

Speaking to Life! at the Chou Sing Chu Foundation, a privately-funded organisation which he set up to promote Chinese culture and learning, he has confidence in the integrity of the ship he is helming.

He says: "In Singapore, people know Popular as Popular bookstore, but we are very diversified. If we are not diversified, we can't survive. This is why we're confident. All other bookshops can close but Popular will survive."

Popular Holdings also has businesses in areas such as publishing, property and educational centres.

The 78-year-old, the youngest son of Popular founder Chou Sing Chu, is a straight talker. He is fond of rhetorical questions and is willing to talk about anything and everything, though not always in the most politically correct terms.

He says: "The book industry is suffering. You hear nothing but bookshops closing. It's because of the Internet age, because of that distraction. Nowadays, you see parents with children, they don't even talk. If children don't talk to their parents, do you think they'll be bothered to read books?"

What makes a Popular bookstore different from others which have gone under - such as Borders and Page One - is that his stores are "one-stop shops", he says.

"How do you attract people to come to a bookshop? You make it convenient," he says. "Then you've got to ask yourself, what is relevant to books? Books are a necessity for education. What other necessities are there for school? So, we brought in stationery."

It is this all-in-one concept - and an injection of money from his property business in Hong Kong - that has seen Popular grow from a single Popular Book Company in 1936, to being named Singapore's Largest Bookstore Chain by the Singapore Book of Records this year, with 70 shops here, 68 in Malaysia and 18 in Hong Kong.

With Popular's robust network of brick-and-mortar shops, he is confident he can weather the rise of online retailers. "The landscape will continue to change, you can't help it," he says with a shrug.

Drawing a parallel to driverless car technology, he points out that despite the advancement, there will always be people who want to experience the "shiok" or pleasurable feeling of manual driving.

"Online retailers don't give you the shiok," he adds. "Popular gives you the shiok."

But "shiok" alone is not enough to keep the bookstore chain afloat. He has had to come up with different ways to keep the brand relevant, one of which is BookFest@Singapore 2014, which starts this weekend at the Suntec Singapore Convention & Exhibition Centre.

"If you ask people to come to a bookshop, you're wasting your time. But if you ask people to come to BookFest, it's a different thing," he says. "BookFest is a lot of fun and for Singaporeans who are kiasu, you can get fantastic deals at BookFest."

But physical shops and events such as BookFest are just one slice of the Popular Holdings pie. In 2006, his company raised eyebrows when it bought 15,070 sq ft of land in Robin Road for $12.5 million, with the intention of turning it into a condominium. The 14-unit One Robin sold out in two months and turned a profit.

But a more recent property venture did not fare as well, and last year Mr Chou dipped into his own pocket to buy over two units of the 19-unit residential project 18 Shelford. The company attributed the lack of buyers to cooling measures and a reworking of loan structures, which affected the sale of larger property units.

The property business in Singapore is now in a "half-hibernating stage". He says with a laugh: "I think we're going to take a break, maybe I'll go fishing until the climate gets better."

Popular Holdings also runs distributorships, publishing houses, a chain of tuition centres in Hong Kong, and will open an English learning centre in Shanghai next year.

While the group managed to achieve $551.8 million in turnover for the financial year which ended in April, not all of its ventures have been successful.

Last year, it opened an 8,000 sq ft store under the Borders brand at Westgate mall, but ended up converting it into a Popular shop after five months. While sales at Borders were "very bad", Mr Chou says that the Popular in its place is breaking even.

"Well, I think there is value in the Borders brand, it's just that I haven't found the right formula and the chemistry," he says. "I will be opening up Borders again, don't worry. But I've met my first Waterloo, so I must take time to nurse the wounds."

While the closure of Borders may mean that he is down, he is by no means out.

"Finding the right formula is not easy. It's by trial and error, trial and error. Popular has come up through 90 years by trial and error," he says.

"We may have setbacks, but one thing about me is that I'm pa si buay zao (Hokkien for "Even if I'm beaten, I won't run away"), so you can be sure I'll be back."

>>>>>>>>>>>><<<<<<<<<<<<<<<<<<<<

Dividend history source :- A Dividend Seeker on SGX

>>>>>>>><<<<<<<<<<<<<<

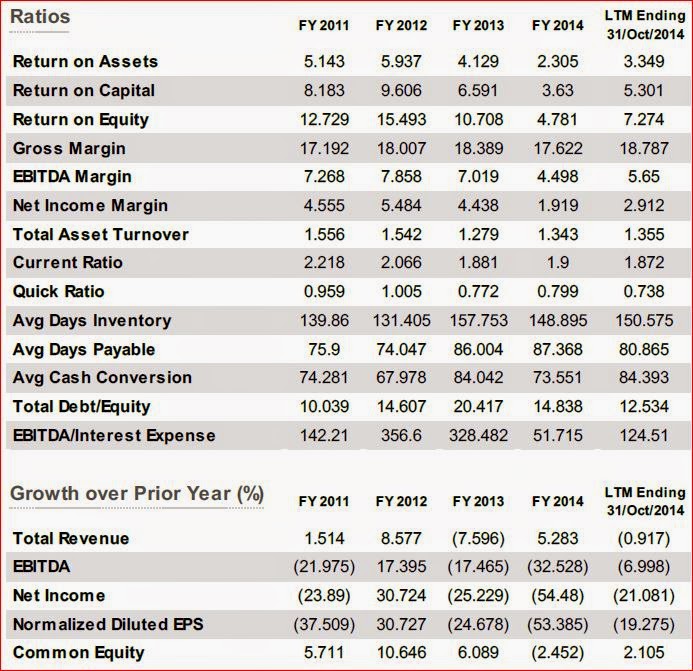

Financials source :- S&P Capital IQ, SES

<<<<<<<<<<<<>>>>>>>>>>>>>>>>>

Shareholdings info :- Popular Holdings

>>>>>>>>>>><<<<<<<<<<<<<

Chart : Businessweek

Lisabel Ting

The Straits Times

Thursday, Dec 11, 2014

Halfway through an hour-long interview with Life!, Popular Holdings chief executive officer Chou Cheng Ngok declares: "I don't read books."

This is ironic, since he runs a large chain of bookstores.

"I read The Economist, Time, Fortune, Forbes, anything that's informative and entertaining," he is quick to point out. "But for me, books are a luxury. You need a quiet spot to sit down and enjoy reading and honestly, I don't have the time."

As Popular celebrates its 90th anniversary this year and holds its annual BookFest@Singapore book and stationery event this weekend, it is clear that the man at its helm is no book-shunning ignoramus. Mr Chou has his eye on the future as the bookstore industry sails into choppy waters, and is charting a course through the rough tides with a steady hand.

Speaking to Life! at the Chou Sing Chu Foundation, a privately-funded organisation which he set up to promote Chinese culture and learning, he has confidence in the integrity of the ship he is helming.

He says: "In Singapore, people know Popular as Popular bookstore, but we are very diversified. If we are not diversified, we can't survive. This is why we're confident. All other bookshops can close but Popular will survive."

Popular Holdings also has businesses in areas such as publishing, property and educational centres.

The 78-year-old, the youngest son of Popular founder Chou Sing Chu, is a straight talker. He is fond of rhetorical questions and is willing to talk about anything and everything, though not always in the most politically correct terms.

He says: "The book industry is suffering. You hear nothing but bookshops closing. It's because of the Internet age, because of that distraction. Nowadays, you see parents with children, they don't even talk. If children don't talk to their parents, do you think they'll be bothered to read books?"

What makes a Popular bookstore different from others which have gone under - such as Borders and Page One - is that his stores are "one-stop shops", he says.

"How do you attract people to come to a bookshop? You make it convenient," he says. "Then you've got to ask yourself, what is relevant to books? Books are a necessity for education. What other necessities are there for school? So, we brought in stationery."

It is this all-in-one concept - and an injection of money from his property business in Hong Kong - that has seen Popular grow from a single Popular Book Company in 1936, to being named Singapore's Largest Bookstore Chain by the Singapore Book of Records this year, with 70 shops here, 68 in Malaysia and 18 in Hong Kong.

With Popular's robust network of brick-and-mortar shops, he is confident he can weather the rise of online retailers. "The landscape will continue to change, you can't help it," he says with a shrug.

Drawing a parallel to driverless car technology, he points out that despite the advancement, there will always be people who want to experience the "shiok" or pleasurable feeling of manual driving.

"Online retailers don't give you the shiok," he adds. "Popular gives you the shiok."

But "shiok" alone is not enough to keep the bookstore chain afloat. He has had to come up with different ways to keep the brand relevant, one of which is BookFest@Singapore 2014, which starts this weekend at the Suntec Singapore Convention & Exhibition Centre.

"If you ask people to come to a bookshop, you're wasting your time. But if you ask people to come to BookFest, it's a different thing," he says. "BookFest is a lot of fun and for Singaporeans who are kiasu, you can get fantastic deals at BookFest."

But physical shops and events such as BookFest are just one slice of the Popular Holdings pie. In 2006, his company raised eyebrows when it bought 15,070 sq ft of land in Robin Road for $12.5 million, with the intention of turning it into a condominium. The 14-unit One Robin sold out in two months and turned a profit.

But a more recent property venture did not fare as well, and last year Mr Chou dipped into his own pocket to buy over two units of the 19-unit residential project 18 Shelford. The company attributed the lack of buyers to cooling measures and a reworking of loan structures, which affected the sale of larger property units.

The property business in Singapore is now in a "half-hibernating stage". He says with a laugh: "I think we're going to take a break, maybe I'll go fishing until the climate gets better."

Popular Holdings also runs distributorships, publishing houses, a chain of tuition centres in Hong Kong, and will open an English learning centre in Shanghai next year.

While the group managed to achieve $551.8 million in turnover for the financial year which ended in April, not all of its ventures have been successful.

Last year, it opened an 8,000 sq ft store under the Borders brand at Westgate mall, but ended up converting it into a Popular shop after five months. While sales at Borders were "very bad", Mr Chou says that the Popular in its place is breaking even.

"Well, I think there is value in the Borders brand, it's just that I haven't found the right formula and the chemistry," he says. "I will be opening up Borders again, don't worry. But I've met my first Waterloo, so I must take time to nurse the wounds."

While the closure of Borders may mean that he is down, he is by no means out.

"Finding the right formula is not easy. It's by trial and error, trial and error. Popular has come up through 90 years by trial and error," he says.

"We may have setbacks, but one thing about me is that I'm pa si buay zao (Hokkien for "Even if I'm beaten, I won't run away"), so you can be sure I'll be back."

>>>>>>>>>>>><<<<<<<<<<<<<<<<<<<<

Dividend history source :- A Dividend Seeker on SGX

>>>>>>>><<<<<<<<<<<<<<

Financials source :- S&P Capital IQ, SES

<<<<<<<<<<<<>>>>>>>>>>>>>>>>>

Shareholdings info :- Popular Holdings

>>>>>>>>>>><<<<<<<<<<<<<

Chart : Businessweek

No comments:

Post a Comment