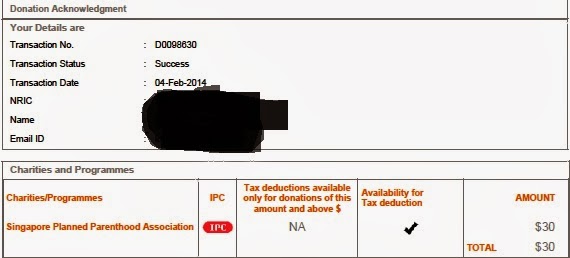

Donated $30 to

Singapore Planned Parenthood Association today.

www.sppa.org.sg

About Us

Formerly known as the Family Planning Association of Singapore, the Singapore Planned Parenthood Association (SPPA) was formed in 1949. We are a voluntary non-profit organisation seeking to promote sexual and reproductive health awareness in Singapore.

SPPA was one of the founder members of the International Planned Parenthood Federation (IPPF) that was formed in 1952, an international body which supports programmes of member associations in the world. In the early years, the Association spearheaded for the wide acceptance of family planning. It was instrumental in helping to persuade the government to adopt an official population policy in 1966.

With the government providing family planning, the Association began advocating family life education and sexuality education promoting programme initiatives and services in the key areas of public education, counselling and training. With such a change in focus and mission, a decision was taken to change the name of the Association to: "The Singapore Planned Parenthood Association".

Our Vision

SPPA envisages a world in which all women, men and young people have access to the information and services they need; a world in which sexuality is recognised both as a natural and precious aspect of life and as a fundamental human right; a world in which choices are fully respected and where stigma and discrimination have no place.

Our Mission

SPPA aims to improve the quality of life of individuals by campaigning for sexual and reproductive health and rights through advocacy and services, especially for poor and vulnerable people. We defend the rights of all young people to enjoy their sexual lives free from all ill health, unwanted pregnancy, violence and discrimination. We support a woman’s right to choose to terminate her pregnancy legally and safely. We strive to eliminate sexually transmitted infections (STIs) and reduce the spread and impact of HIV&AIDS.

Our Core Values

SPPA believes that sexual and reproductive rights should be guaranteed for everyone because they are internationally recognised basic human rights.

We are committed to gender equality, and to eliminating the discrimination which threatens individual well-being and leads to the widespread violation of health and human rights, particularly those of young women.

We value diversity and especially emphasize the participation of young people and people living with HIV&AIDS in our governance and in our programmes. We consider the spirit of voluntarism to be central to achieving our mandate and advancing our cause.

We are committed to working in partnership with communities, governments, other organizations and donors.

What we do:

-Sexuality Education Talks, Workshops and Camps for youths and adults

-Marriage Enrichment Talks and Workshops

-Parenting Talks and Workshops

-Specialised training workshops for teachers and social workers

-Public Forums on Sexual & Reproductive Health issues like contraception, fertility, sexual intimacy, andropause, menpause, etc.

-Research on Sexual and Reproductive Health issues

-Telephone & Face to Face Counselling

Address

Singapore Planned Parenthood Association

Block 3A Holland Close # 01-55

Singapore 272003

Counselling Hotline:

Telephone: 1800 - 7758582