Divested

Cache Logistics Trust 4 lots in this

week under Cash portfolio at break even as part of regular portfolio re-balancing. Remaining total holding of it now at 2 lots.

Divestment happened after it went XD on 29 Oct so l am still entitled to its dividend amount to be received around 27 Nov. It just released 3Q2013 financial results. DPU slightly lowered by 0.8% due to higher number of issued units. NPI higher by 8.5% for 3Q2013. Property expenses gone up 27.7% from Qtr 2 to Qtr 3 due to one off reversal of expense accrual in Qtr 2. As of end Qtr 3, its NAV was valued at $0.97 but Mr Market believes that it is worth much more with its Friday closing price at $1.19. No debt re-financing requirement till 2015. 70% debts hedged by way of fixed interest rate swaps. Its $375 mil secured term loan (includes $62 mil undrawn) are well spread out across 19 international banks. Continued to maintain a portfolio occupancy at 100% in 3Q2013. No

lease expiry renewal risk for the remaining months of 2013. And only 3% of total GFA lease to be renewed in year 2014. Over 85% of GFA taken up by MNCs and government entities.

Invested into

HPH Trust 1 lot in this week. Its 3Q2013 financial results did not go well with investors but l do not think it is justified. Its 3Q2013 revenue and profit was +1% and -2% respectively versus last year <--- flat results. A flat financial results is quite admirable when the world economy is almost in turmoil and freight rate recovery is still quite shaky at the moment. It is in Net Current Liabilities status as of end Sept'13 but overall still at Net Assets status; due to timing of US$3.6 billion term loan facility agreement for the refinancing of the existing facilities which was signed in late Sept'13. It is still in free cash flow status. Higher profit from new acquired Yantian container terminals was partially offset by lower profit in Hongkong international terminals.

Reduced

Croesus Retail Trust 2 lots in this week

under Cash portfolio so my total holding of it now at 1 lot; for usual portfolio re-balancing purpose. Nett gain $31 or 1.8% returns which is better than bank savings deposit rate. It has 100% occupancy across all its four retail business properties in Japan. Around 1% of leases are subjected for

renewals in years 2013/2014; and 26% of leases are for renewals in year

2015. Each of the properties is strategically locate within its submarket, being directly connected via major transportation nodes. 61.5% of its gross rental income is derived from leases structured as fixed term leases, giving it greater flexibility to adjust rentals and tenant composition, or variable rent, allowing it to share any income upside with its tenants. It has very high gearing of around 43.7% but at very cheap interest costs. Awaiting its financial results for the period ended 30 Sept'13 to be released on 13 Nov for decision to further increase or reduce positions in it.

Reduced Mapletree Greater China Commercial Trust 5 lots in

this week; for usual portfolio re-balancing purpose. Nett gain $51 or 1.1% returns which is better than bank savings deposit rate over one week holding period. Remaining total holding of it now at 4 lots. It

just released 7M2014 (7 Mar'13 to 30 Sep'13) financial results and made

comparisons against forecast made during IPO launch. Achieved higher

NPI +8.6%. Available distributable income +10.5%. Its NAV as of end

Sep'13 was at $0.98 and its last done share price on this Friday was at a

discount to NAV at $0.93. Earliest debt expiry is in year 2015 and is

well staggered into year 2018 at average 33% each year. Borrowings

interest rate for 71% of total debt fixed till year 2015. Portfolio

occupancy rate at 99% as of end Sep'13. 87% of expiring leases in

current financial year have been renewed or re-let. To ensure stability

of S$ distributable income, it has hedged 100% of HK$ distributable

income for Year 1 and 90% for Year 2. In addition, it has progressively

converted CNY distributable income to SGD.

Increase my position in

Asian Pay TV

(APTT) 1 lot in this week so l have total holding of 24 lots now under Cash

portfolio. Recently acquired Taiwan Broadband Communications (TBC). Subscriber households have grown, average revenue per subscriber is constant, penetration rates have increased, all leading to growth in TBC earnings. Taiwan regulator already approved TBC expansion to greater Taichung which opens up opportunity to increase household network coverage by up to 400,000. NAV as of end June at $0.94 and last done share price at discount of $0.775. Interest rate swaps have been entered into, which fix a significant portion of the interest rate exposure from TBC's borrowings. For growth in penetration rates, premium digital cable tv and broadband to increase as a result of up-selling and bundling strategies, increased set-top box penetration, greater availability of digital content, need for reliable internet access. Network expansion through re-zoning is an opportunity for APTT. Positive ongoing discussions with Taiwan tax authorities to resolve tax dispute. There were huge numbers of traders (or short sellers) queueing to sell

on this Friday morning and early afternoon but it was very much reduced

towards end of the day; which did not happen to APTT alone but it was

almost across the board thingy. Awaiting its next financial results for the period ended 30 Sept'13 to be released on 12 Nov for decision to increase or reduce positions in it.

Divested all away on

Thai Village 11 lots in this week for nett gain $67 as part of usual portfolio re-balancing; before announcement of a private share placement. The shares placement will see two new major shareholders in the directorship positions in Thai Village with their combined 46% shareholding. Thai Village will diversify into development of commercial property as its new business. The new subscribers experience and strong network in their field of works and background will be a total game changer for Thai Village.

Added

Tee International 1 lot in this week under Cash portfolio so total holding in it now at 6 lots. It delivered mix financial results for 1Q2014; revenue +ve 24% driven by ongoing and completed engineering projects and profit -ve 62% due to higher administrative expenses and higher opex. Higher administrative expenses was due to one off bonus payment to employees and higher staff costs and headcount in line with its business and operations expansion. Giving extra bonuses is a good thing to do as it motivates employees which is in recognition of their hard works. Higher opex due to unrealized forex losses that resulted from the depreciation of the MYR against the SGD. It is in net cash used at the moment mainly due to cash received from receivables net off payment to trade payables, interest and income tax expenses and decrease in development properties. Its chief executive & managing director, Mr Phua has 51% shareholding in Tee Intl as shown in the 2013 annual report so one can be well assured that he will run this company with very much more care and growing it at the same time.

Added

Singapore Shipping Corp (SSC) 5 lots in this week so total holding of it now at 8 lots under Cash portfolio. The acquired agency and logistics business completed in April is almost god-send as SSC existing business segment of ship owning and management will be quite soft in FY2014. One ship reaching its end of charter and economic useful life by end of 2013 and two ships going into dry docking so a reduction in income from the ship owning segment. However, the newly acquired business can more than make up for the shortfall in the ship owning business. For its 1Q2014 financial results, revenue +82.8%, profit +55.7%, free cash flow status.

Portfolio walk since previous posting :-

+$4,577 Total Returns as of 25 October

+$151 Gain on sales of Cache Logistics, Mapletree Greater China, Croesus Retail, Thai Village

-$801 Unrealised positions worsened

+$3,927 Total Returns as of 01 November

Previous posting :-

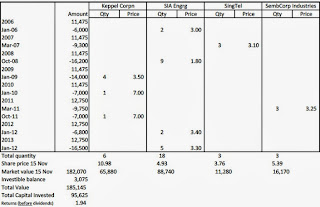

Cash - Closing Status 25 Oct