Invested into Croesus Retail Trust 3 lots in this week under SRS portfolio. Only less than 1% of leases are subjected for renewals in years 2013/2014; and 26% of leases are for renewals in year 2015. Unless l am stuck with my investment so l do not really worry of year 2015. However, so long that it can generate dividend yield better than bank deposit rate for my investment costs in it of $2.9k so l am fine with a forced passive income investment. Based on my investment costs in it and dividend rate of $0.0739 so l can expect an annual dividend yield 7.7%.

Sold away Sin Heng Rights of 3,750 shares in this week for a proceeds of $145.

Divested Frasers Centrepoint Trust (FrasersCT) 2 lots for nett gain of $42. The divestment happened before it is going XD on 29 July but unfortunately it was slightly lower by 73% of the full dividend amount; 2 lots x dividend rate $0.0285 x 0.73 = $42. Payment of the dividend will happen on 29 Aug so, l have already collected its dividend amount in advance. On a side note however, this week's divestment is the third time of divestment on FrasersCT within July month under SRS portfolio so, in total l have collected $127 (1st divestment $44 + 2nd divestment $42 + 3rd divestment $42) of advance dividend and it is 2.2 times more ---> 2 lots x dividend rate $0.0285 x 2.2 = $127.

Divested Mapletree Logistics 6 lots in this week under SRS portfolio for $111 nett gain. It declared dividend rate $0.018 last week for its 1Q14 results so expected dividend amount is 6 lots x $0.018 = $108. The $111 nett gain is almost par to the full dividend amount and l have already collected it in advance as its actual payment date will only happen on 29 Aug.

Also in this week under SRS portfolio, l have divested away Singapore Post 10 lots for $160 nett gain. Assuming that its next dividend rate is $0.0125 and XD on 14 Aug so, the expected dividend amount is 10 lots x dividend rate $0.0125 = $125; and also assuming that it has same payment date as last year on 31 Aug. The nett gain $160 is higher than the expected dividend amount and l have already collected it in advance with this divestment.

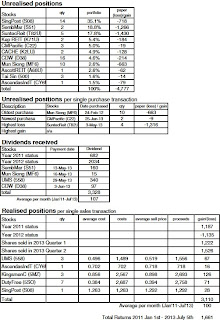

Portfolio walk since previous posting :-

+$7,192 Total Returns as of 19 July

+$458 Gain on sales of Sin Heng Rights, Fraser Centrepoint Trust, SingPost, Mapletree Logistics

+$9 Unrealised positions improved

+$7,659 Total Returns as of 26 July

previous posting :- SRS - Closing status 19 July

Sold away Sin Heng Rights of 3,750 shares in this week for a proceeds of $145.

Divested Frasers Centrepoint Trust (FrasersCT) 2 lots for nett gain of $42. The divestment happened before it is going XD on 29 July but unfortunately it was slightly lower by 73% of the full dividend amount; 2 lots x dividend rate $0.0285 x 0.73 = $42. Payment of the dividend will happen on 29 Aug so, l have already collected its dividend amount in advance. On a side note however, this week's divestment is the third time of divestment on FrasersCT within July month under SRS portfolio so, in total l have collected $127 (1st divestment $44 + 2nd divestment $42 + 3rd divestment $42) of advance dividend and it is 2.2 times more ---> 2 lots x dividend rate $0.0285 x 2.2 = $127.

Divested Mapletree Logistics 6 lots in this week under SRS portfolio for $111 nett gain. It declared dividend rate $0.018 last week for its 1Q14 results so expected dividend amount is 6 lots x $0.018 = $108. The $111 nett gain is almost par to the full dividend amount and l have already collected it in advance as its actual payment date will only happen on 29 Aug.

Also in this week under SRS portfolio, l have divested away Singapore Post 10 lots for $160 nett gain. Assuming that its next dividend rate is $0.0125 and XD on 14 Aug so, the expected dividend amount is 10 lots x dividend rate $0.0125 = $125; and also assuming that it has same payment date as last year on 31 Aug. The nett gain $160 is higher than the expected dividend amount and l have already collected it in advance with this divestment.

Portfolio walk since previous posting :-

+$7,192 Total Returns as of 19 July

+$458 Gain on sales of Sin Heng Rights, Fraser Centrepoint Trust, SingPost, Mapletree Logistics

+$9 Unrealised positions improved

+$7,659 Total Returns as of 26 July

previous posting :- SRS - Closing status 19 July